MOLINE, Ill — Over the past few months, Americans have noticed the interest rates on credit cards, bank loans and home mortgages - just to name a few - have been steadily rising, but consumers should expect interest rates to climb even higher in the upcoming months.

Monday, June 20 on Good Morning Quad Cities, Financial Advisor Mark Grywacheski with Quad Cities Investment Group recapped the U.S. Federal Reserve's recent move to raise the federal funds rate by 0.75% and talked about concerns the country is headed toward another recession.

Find the conversation between Grywacheski and News 8's Linda Swinford below.

Swinford: On Wednesday, the Federal Reserve raised the benchmark fed funds rate by 0.75% which was the largest single rate hike since 1994. Understandably, people may not understand a lot about the Federal Reserve and what is going on with these interest rate hikes. So, could you walk us through this process?

Grywacheski: As part of its mandate, the Federal Reserve tries to manipulate spending, investment and inflation to promote the health of the U.S. economy. One of its main tools is the management of the benchmark fed funds rate, which often serves as the basis for many forms of debt. So when the fed funds rate goes higher, you’ll typically see rates on credit cards, bank loans and variable-rate mortgages also go higher.

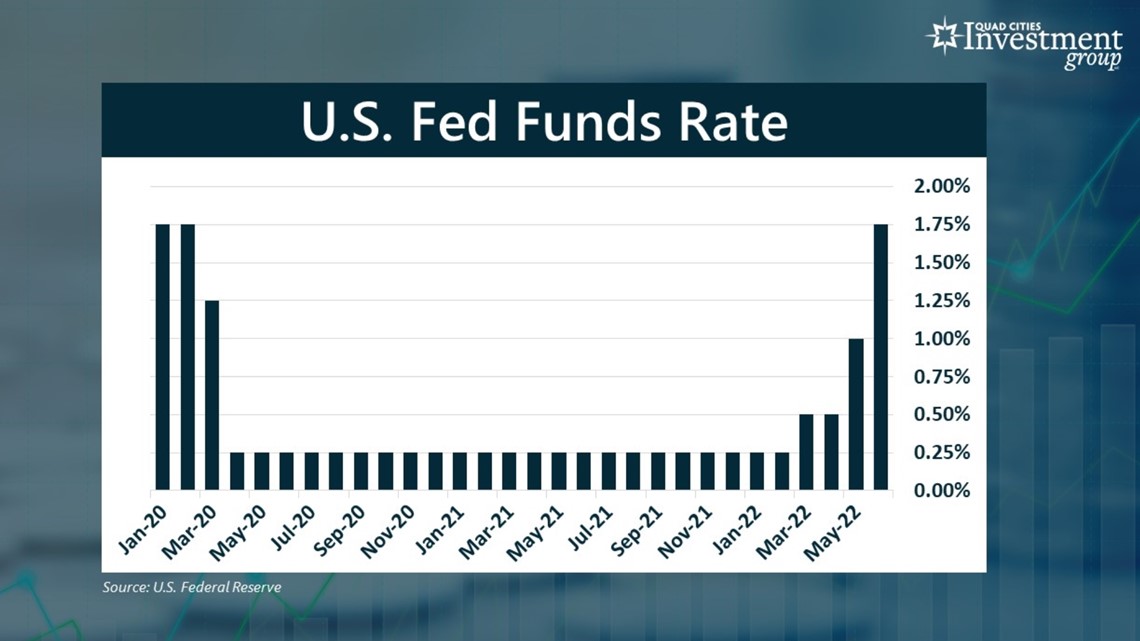

Back in March and April 2020, the Fed slashed the federal funds rate to near-0%. The goal was that ultra-low interest rates would artificially boost consumer demand for goods and services and, thus, help stimulate economic growth during the pandemic.

But with inflation now out of control, the Fed hopes raising interest rates will force consumers to cut back on spending. Lower consumer demand should help drive consumer prices lower.

We’ve already seen a number of interest rate hikes by the Federal Reserve, but how many more should we expect in the upcoming months?

Historically, when the Fed raises interest rates it does so in gradual 0.25% increments. But because inflation has risen so high so fast, the Fed has adopted a very aggressive agenda of interest rate hikes.

Back in March, the Fed raised the federal funds rate by 0.25%. Two months later, in May, the Fed raised it by 0.50%. On Wednesday, the Fed raised the rate by 0.75% - the largest single rate hike since 1994.

Next month, the Fed is expected to raise the rate by another 0.50%. This should be followed by three more 0.25% rate hikes by year-end and two more in 2023.

After all is said and done, the current federal funds rate is expected to double to 3.5%. So, there are a lot of rate hikes still to come.

It seems like every day we’re hearing more and more concerns about the economy going back into recession. How likely are we to go into recession, and when do you think that might happen?

There’s tremendous concern over the future health of the U.S. economy. Nobody knows for sure if/when the economy might go into recession. Does the economy just barely remain strong enough to avoid a recession? Or if we get one, is it short-lived and mild or longer and more severe?

All these interest rate hikes will take about six to nine months to filter their way through the economy. So many are projecting a recession in early-to-mid 2023.

But it all goes back to these interest rate hikes. To go from near-0% to an expected rate of 3.5% in such a short window of time causes a lot of strain on consumers, businesses and the economy.

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.