SCOTT COUNTY, Iowa — If you live Scott County, you may have noticed an increase in your home's assessed value. According to the county assessor, this is because of the rising housing market.

While typical increases are not unusual, increases this big are.

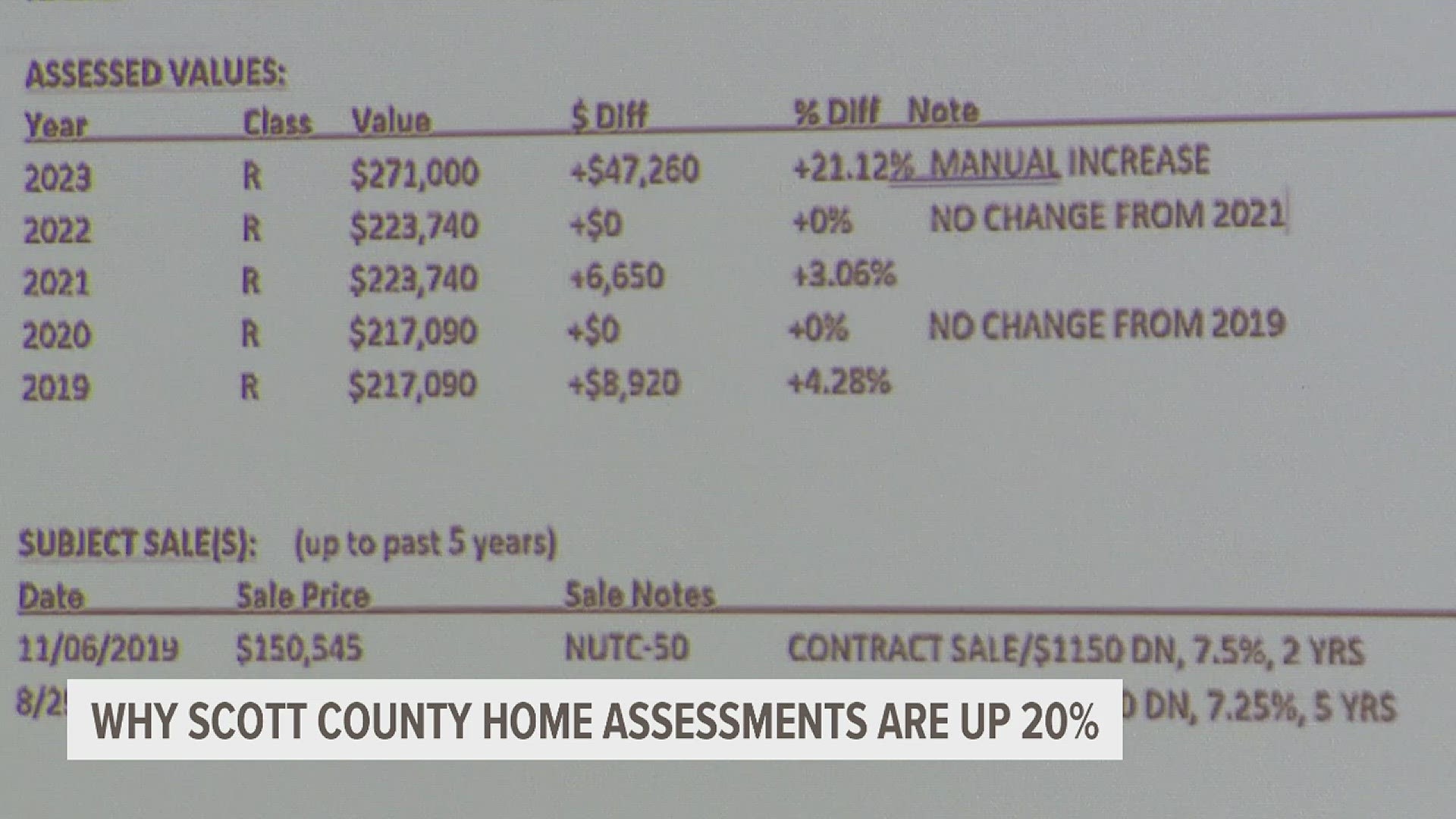

Values have increased by about 20% in Scott County over the past two years. Some people have had their home value increase by over $125,000, which is great if you are looking to sell, but not so great if aren't selling and now have to pay higher property taxes.

These values are calculated based on a multitude of factors including how much nearby homes have sold for, the size of your home and whether you have a finished basement.

On May 1, the Scott County Assessor Board of Review began the process of reviewing the 350 petitions from homeowners who aren't happy. The board is made up of three-to-five people and operates independently from the county's assessor's office.

The board has the power to confirm or adjust any assessment. Each review lasts about 5-to-10 minutes, and they decide if the assessment is accurate or needs to be changed; In most cases, the assessment is unchanged. The Board of Review hopes to have all of the petitions reviewed by the end of May.

News 8 spoke with one Bettendorf man who petitioned his assessment after his home increased by $75,000.

"We protested it due the fact that we look at very similar homes with square footage... and there are homes whose square footage is larger than ours that have a lower assessed tax value than ours," Brandon Babcock said. He has lived in his house for five years and is worried about being able to afford the future increase in property taxes.

There are things being done at the state level to hopefully lessen the burden of increased property taxes.

On Monday, May 1, Gov. Kim Reynolds along with other Iowa Legislators passed House File 718. This new law will, "curb the growth of local governments in a responsible manner and begin reducing property taxes next year."

Legislators say the bill is estimated to provide $100 million in relief.