DAVENPORT, Iowa — The Quad Cities Chamber has shared the results of their 2023 Q2 Market Report, an analysis of the economic health of the Quad Cities region compared to U.S. averages from March to June.

The report was written by Dr. Bill Polley, director of business intelligence for the Chamber.

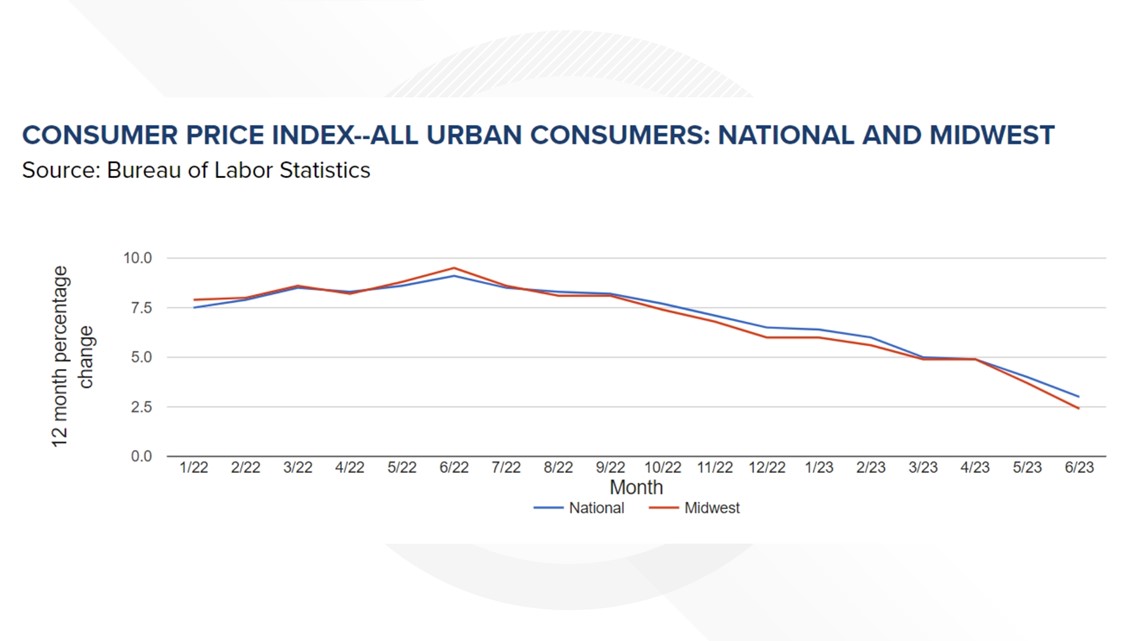

Inflation has decreased significantly from its peak in June 2022, when the consumer price index (CPI), or measure of inflation, hit 9.1%. The current national CPI is at 3%, and the Midwest CPI is at 2.5%.

From August 2022 to August 2023 in the Midwest, there was a 3.4% increase in the CPI, slightly less than the national rate of 3.7%, Polley wrote. Midwest inflation mostly followed national inflation. Natural gas saw a larger price decrease in the Midwest at 28.6%, compared to 16.5% nationally.

"The first part of 2023 continued to widen the gap between utility prices in the Midwest compared to the rest of the nation," Polley wrote. "The Quad Cities region continues to be among the lowest cost regions of the country for energy."

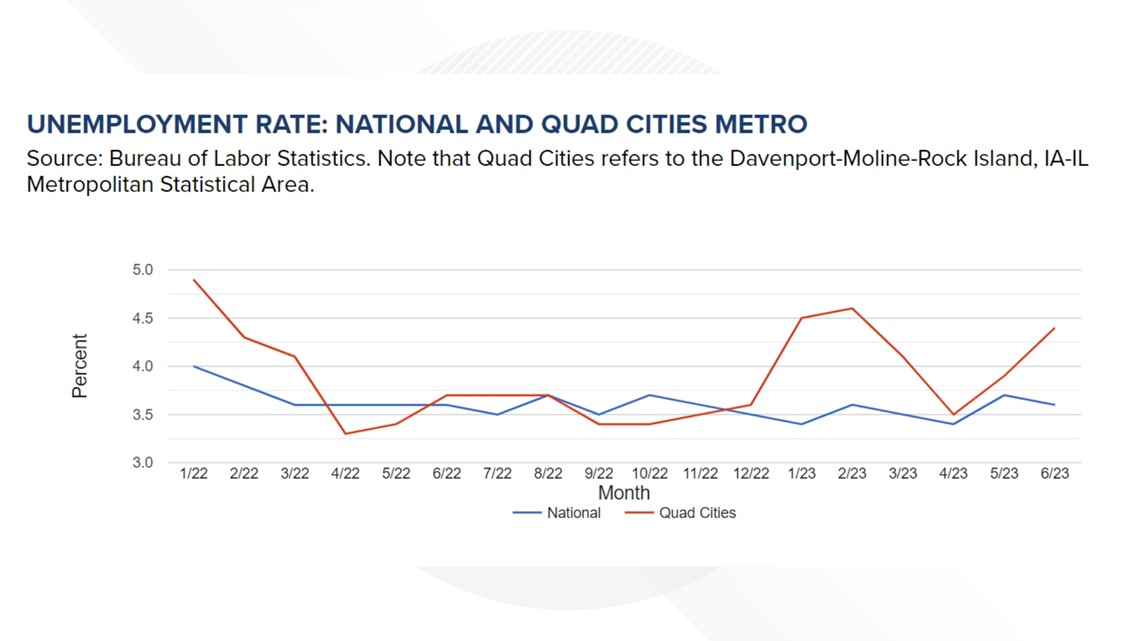

From June 2022 to June 2023, the Quad Cities labor market added about 2,600 jobs, according to the U.S. Bureau of Labor Statistics. The second quarter ended with 186,600 nonfarm jobs, Polley wrote.

At the end of the second quarter in June, the Quad Cities area had an unemployment rate of about 4.4%, up slightly from the most recent low of 3.5% in April. The rate ranged from 3.6% in Scott County to 5.3% in Rock Island County.

Polley wrote unemployment rates below 4% have the potential to drive up wages through tight job markets. This could affect the Quad Cities region, where specific types of jobs are clustered.

The Scott County labor market is particularly strong, with wages rising 10.4% in the first quarter 2021. It was the 36th highest wage increase out of the 361 most populous counties in the U.S., according to the U.S. Bureau of Labor Statistics. Scott County is the only county in the Quad Cities area on that list.

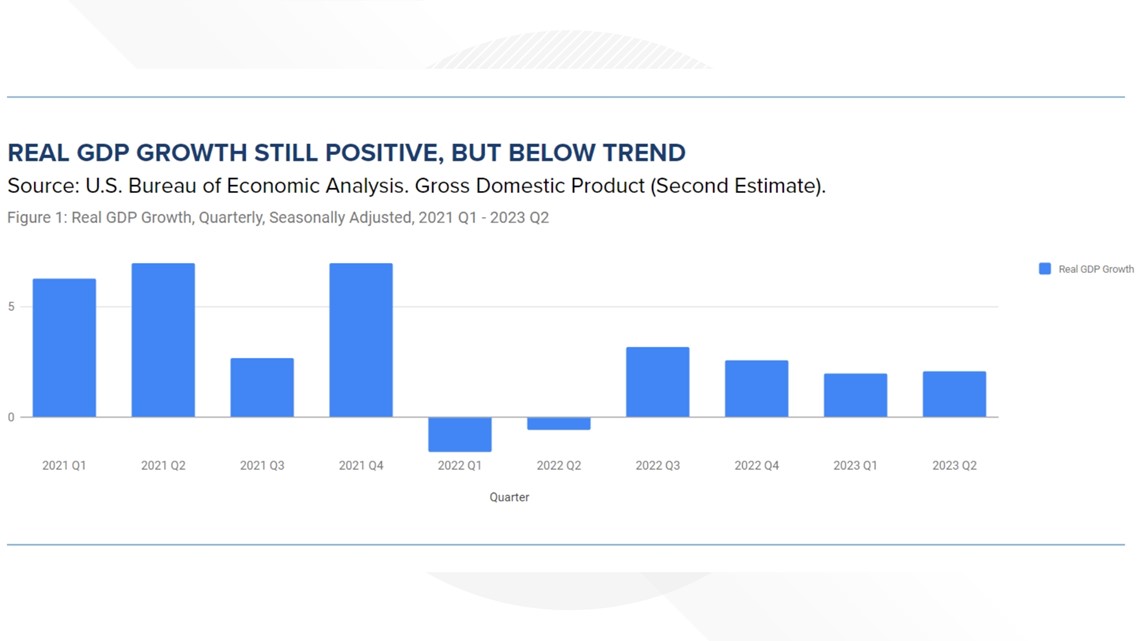

Polley wrote stronger-than-expected economic growth based on GDP projections could keep pressure on wages for the rest of 2023, unless the Federal Reserve can bring inflation down to the 2-3% range.

Concerns over a recession have been brewing since inflation increased in late 2021, but a national real GDP growth of 2.1% in the second quarter proves a recession is not inevitable, Polley wrote.

Real GDP, or real gross domestic product, is a measure of the value of all the goods and services produced by an economy.

The U.S. economy was able to avoid a recession thanks to the Federal Reserve's communication strategy keeping inflation expectations contained, Polley wrote.

"Enough market participants believe that the Fed is serious about bringing inflation down, even at the risk of slowing the economy," he added. "Few are willing to take the other side of the bet."

This potentially results in a "soft landing," where inflation comes down without a recession.

Comparing to the 1990s

Polley compared the current inflation and interest rate increase with the tightening cycle from 1993-1998. The Fed also began to communicate its interest rate changes with press releases and TV appearances, a change from the 1970s. Though this current situation is different, with the shock of the pandemic driving talks of a recession, the real GDP saw growth much sooner than it did during the slowdown in the 1990s, Polley wrote.

Third quarter potential

Polley is cautiously optimistic about the trajectory of the real GDP. The Federal Reserve Bank of Atlanta projects a third-quarter real GDP growth of 4.9%, though this has trended down in recent days. However, this kind of growth could prompt the Fed to keep interest rates higher for longer, hurting sectors like manufacturing that are sensitive to rate increases, Polley wrote.

Though Quad Cities manufacturing could take a hit from continued high rates, economic weakness in China could give it a boost, Polley wrote. Other sectors, like housing, consumer goods, and business are picking up the slack. Polley calls this a "rolling recession," where slowdown and recovery shift across sectors and regions over time. He wrote this suggests sector-specific or region-specific slowdowns will be short-lived.

Illinois and Iowa

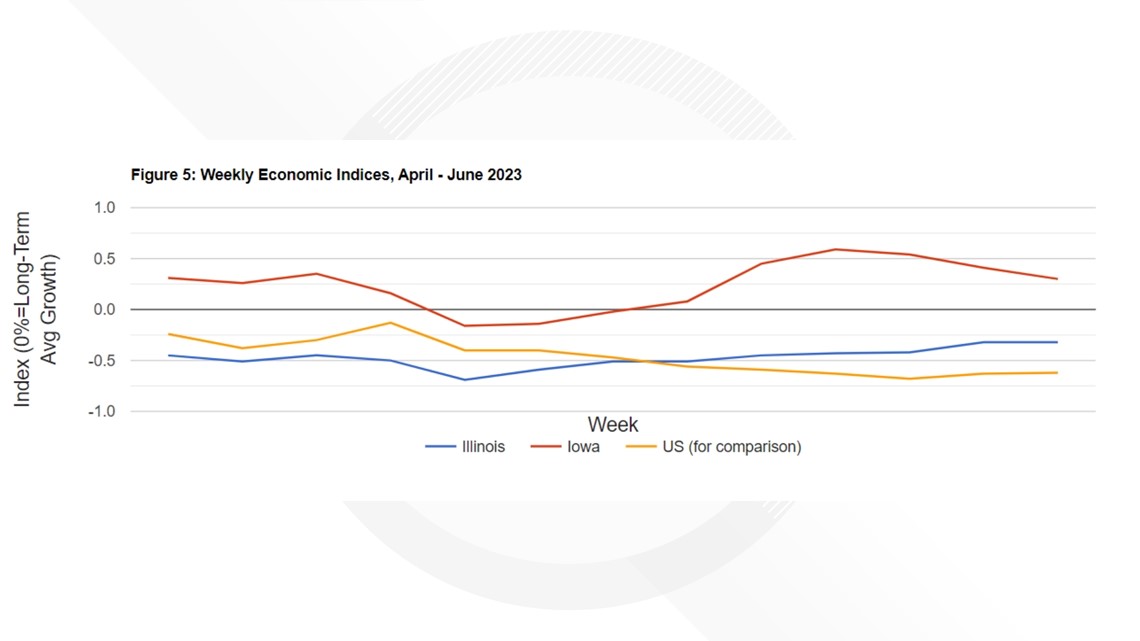

The Quad Cities region is in a good position to ride out any economic uncertainty while waiting for inflation to slow, Polley wrote. He references a study by Notre Dame University, Banco de España, National Bureau of Economic Research and Center for Economic and Policy Research that measures the week-by-week economic health of each state in the U.S.

The study's dashboard shows Iowa is above the long-term trend, or 0 on the graph. Illinois and the U.S. are below the long-term trend, but Illinois is above the U.S.

Watch more news, weather and sports on News 8's YouTube channel