MOLINE, Ill — Over the past few months, there’s been a growing concern on the future outlook for the US labor market. Ford Motor Company, Amazon, IBM, Microsoft are among a rapidly growing list of Fortune 500 companies that have recently announced significant employee layoffs. But on Friday, the Department of Labor reported the national unemployment rate declined to a new 50-year low of 3.4%.

Mark Grywacheski with the Quad Cities Investment Group joined WQAD's David Bohlman to discuss what this latest employment report means for the state of the economy.

Bohlman: What did we learn about the labor market from this latest Employment Report?

Grywacheski: There’s a number of areas within the economy that are struggling- the housing market, business spending, manufacturing, we’re starting to see some cracks form in consumer spending- but the labor market is an area that still remains quite strong.

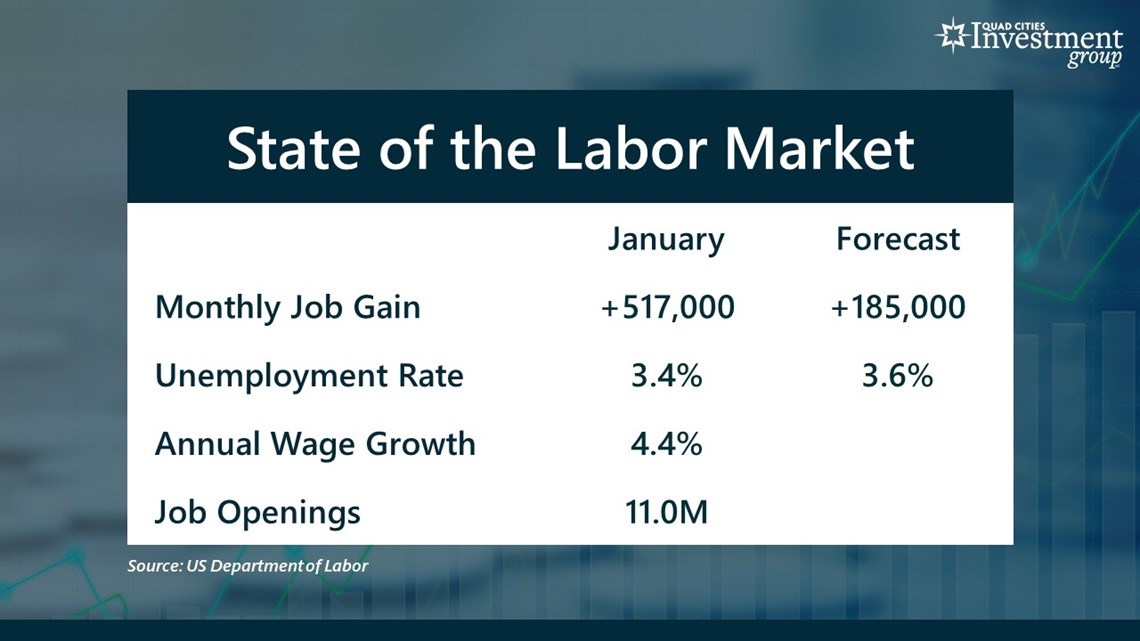

- In January, the economy added 517K new jobs, above the 185K that Wall Street had forecast.

- The national unemployment rate fell from 3.5% to 3.4%. Wall Street was actually expecting the unemployment rate to increase from 3.5% up to 3.6%.

- There’s currently 11M unfilled job openings across the nation.

But one of the areas of concern is annual wage growth, which is at 4.4%. With inflation currently at 5.7%, wages are still not keeping up with inflation. And I think that’s why we’re starting to see these cracks form in consumer spending.

Bohlman: We typically associate a strong labor market with a strong economy. If the labor market is so strong, why are we still projecting a recession this year?

Grywacheski: Typically a strong labor market drives a strong economy. When people have jobs, they have money to spend- which then drives our economy forward. But inflation is still high at 5.7%. And now we have high interest rates, which makes it more expensive to borrow money. For example, with mortgage rates at 6-7%, we’ve seen a substantial decline in home purchases. So, even though a lot of people still have jobs, they’re starting to spend less money which may ultimately send the economy into recession.

Bohlman: We keep on hearing many of these Fortune 500 companies announcing mass layoffs. With all these layoffs, why do we still see such strength in the labor market?

Grywacheski: We’re starting to see a separation between the various sectors of the economy. Back in 2020 and into the 1st 1/2 of 2021, government lockdowns forced a massive shift in consumer spending away from services (bars/restaurants/movie theaters/the travel industry) and into the purchase of physical goods. It also forced an increased reliance on technology- we did much of our shopping online.

But as the economy reopened, we continue to see this return shift in resources and labor out of physical goods and back into services. Yes, we’re hearing a lot of layoffs from manufacturing and tech companies, but that’s being offset by a surge in jobs back into the service industries.

Bohlman: What’s the outlook for the labor market the rest of this year?

Grywacheski: The unemployment rate is expected to rise from its current 3.5% to around 4.5%-5% by year-end.

But one positive factor for the labor market is there’s a large buildup of unfilled job openings. Currently, there’s about 11 million unfilled job openings across the country. So, that should act as some type of “buffer” to the labor market. In other words, if a business enters a rough patch, ideally they could simply eliminate some of their unfilled job openings before they lay-off any existing employees.

Watch more news, weather and sports on News 8's YouTube channel