MOLINE, Ill. — Stock market investors finally had reason to celebrate last week. The S&P 500 gained 1.9%, the Nasdaq added 4.6% while the Dow Jones Industrial Average rose 0.7%. It was the first time this year that the Nasdaq reported a gain for five consecutive days.

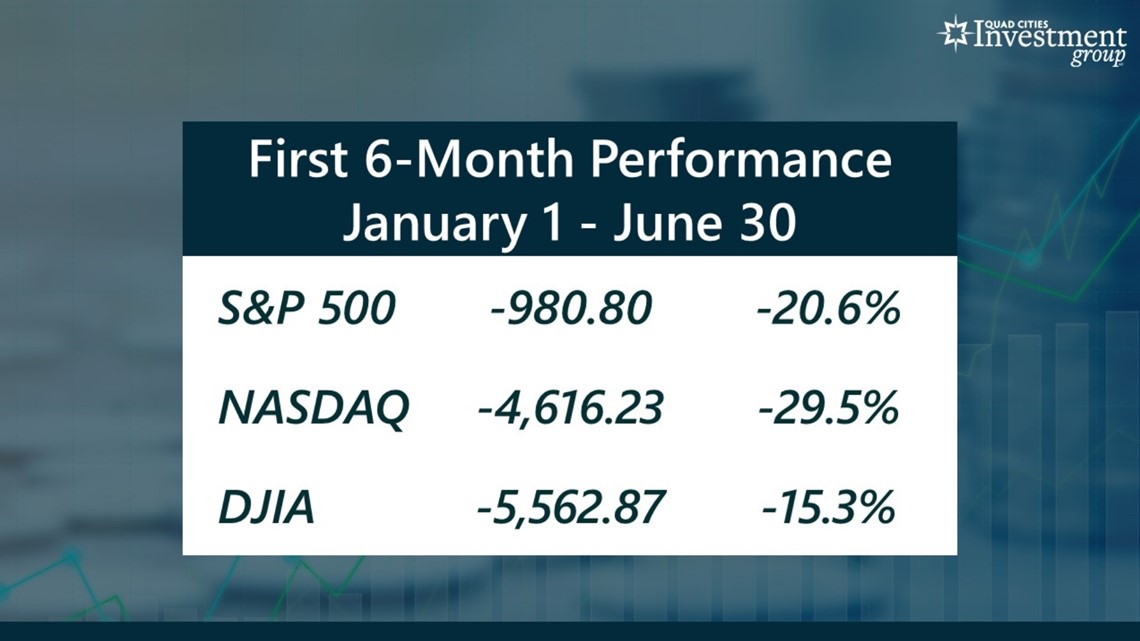

Despite last week’s rally in the stock market, the first six months of the year were a fairly brutal experience for investors. From Jan. 1 to June 30, all three major stock indexes posted significant losses.

Monday, July 11 on Good Morning Quad Cities, Financial Advisor Mark Grywacheski with the Quad Cities Investment Group recapped U.S. stock market performance for the first half of 2022 and offered some predictions on when the economy could go into a recession.

Find the conversation between Grywacheski and News 8's Linda Swinford below.

Swinford: What was behind such a deep sell-off in the stock market for the first half of the year?

Grywacheski: The graph above shows just how expansive and deep this sell-off has been ... This sell-off is being caused by growing concerns the economy is heading towards a recession. To help get this high inflation under control, the Federal Reserve is aggressively raising interest rates. That very potent combination of high inflation and rising interest rates has Wall Street projecting that it’s a matter of when - not if - the economy goes into recession.

If we do get a recession, when does Wall Street think that will happen?

There’s no certainty the economy will go into a recession. Some argue we’re already in one. Others argue it'll happen sometime in the second half of 2023 or early 2024. But the consensus is that if we do get one, it would most likely happen within the next 12 months.

On Friday, the Department of Labor released the monthly Employment Report for June. What did this latest report tell us about the state of the U.S. labor market?

The labor market is far from perfect, but it is one of those parts of the economy that remains fairly strong. We continue to see a steady pace of job growth and the national unemployment rate has held firm at 3.6% for the past four months.

But one of the biggest challenges has been getting people to return to the labor market after the pandemic. Back in March and April 2020, the labor market lost 22 million jobs. Here we are over two years later, and we’ve yet to recapture 524,000 of those lost jobs

Then look at the labor participation rate, which reports the percentage of Americans that are either working or actively looking for work. The LPR is still at a 45-year low. This means that millions of Americans that were once working are no longer working and, more importantly, not even looking for work.

And the resulting labor shortage - especially in manufacturing, shipping and transportation - is limiting the availability of goods, which helps keep consumer prices high.

With all the concern over a recession, how do you think this will impact the labor market?

Whether we go into a recession or not, the economy is expected to weaken over the next 12 months. It’s only natural that weakness eventually impacts the labor market.

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.