MOLINE, Ill. — According to credit reporting agency TransUnion, Americans accumulated nearly $1 trillion in credit card debt last year – a record high. In its recent study, TransUnion reports that both credit card balances - as well as delinquencies- have soared over the past two years.

The average interest rate charged on credit card balances has also risen to over 23%.

News 8's David Bohlman spoke with Quad Cities Investment Group's Mark Grywacheski to break down the report and what it means for consumers.

Watch more "Your Money with Mark" segments on Good Morning Quad Cities or on News 8's YouTube channel.

Bohlman: When you take a closer look at this latest TransUnion report, what surprises you the most?

Grywacheski: For me, the biggest takeaway from this report is that it really conveys the extent that Americans have been forced to rely on their credit cards over the past two years:

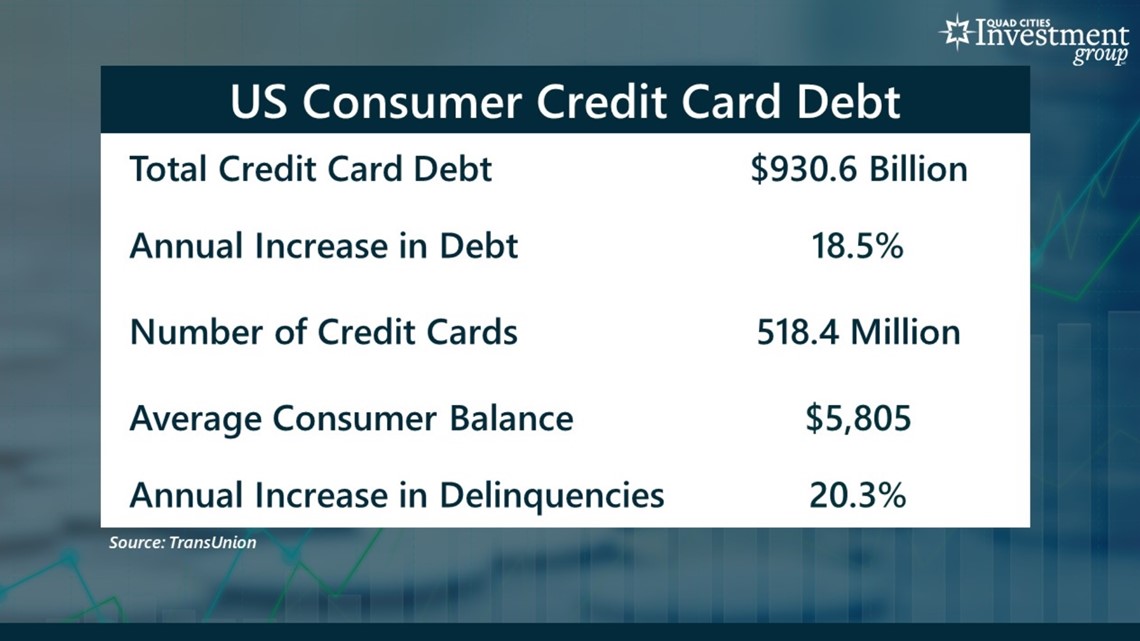

- In Q4, consumer credit card debt reached an all-time high of $930.6B.

- This is an 18.5% increase over the past year.

- The number of credit cards held by consumers is 518.4M – the first time the number of credit cards has breached the 500M mark. This is an increase of 6.7% over the prior year. So, even though the number of credit cards has increased by 6.7%, the amount of credit card debt has increased by 18.5%.

- The average consumer has $5,805 in credit card debt. This is up 13% from last year.

- Credit card delinquencies- defined as being late on your payment by more than 30-90 days- have increased by 20.3% since last year.

Bohlman: As part of its report, TransUnion notes that 82% of consumers believe the U.S. is currently in a recession or that there will be a recession later this year. If there’s such a concern over a recession, why are consumers spending so much money on their credit cards?

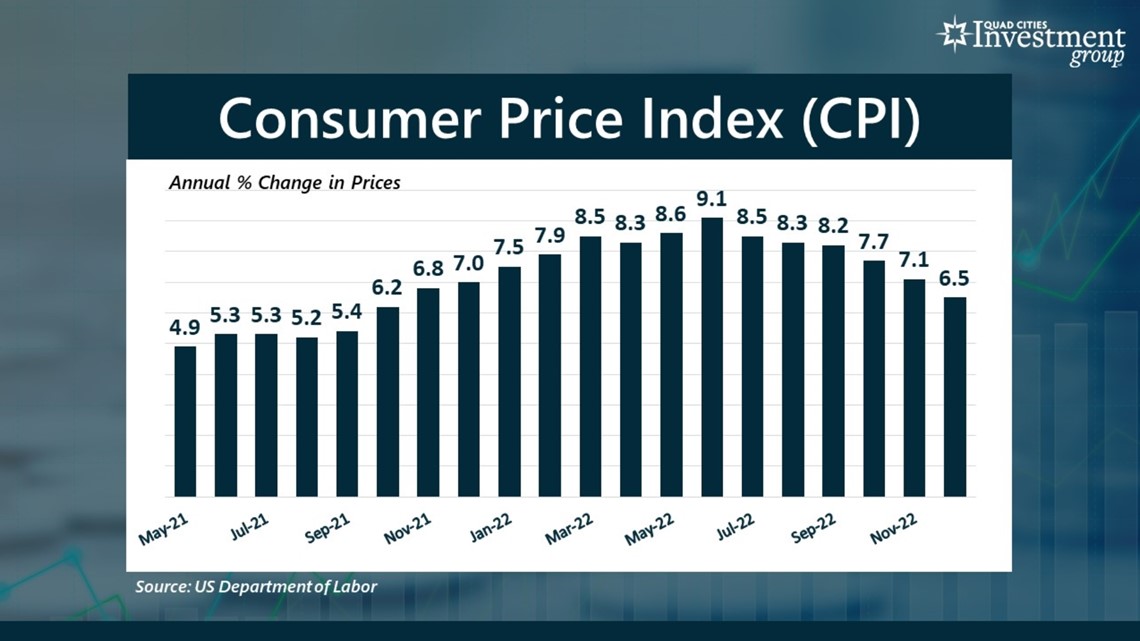

Grywacheski: Without question, the biggest driver of this surge in credit card debt is inflation. Two years ago this month, back in February 2021, inflation was reported at just 1.7%.

But over the past two years, inflation has absolutely skyrocketed. Inflation has eased up slightly from its peak of 9.1% back in June, but it’s still well above that 2% target rate of inflation we’d like to return to.

And for nearly two years, consumer prices have been rising faster than employee wages. So, to help make ends meet, people have been forced to pull money from their savings account, retirement and take on more and more credit card debt.

Bohlman: What advice do you have for people that are carrying a large credit card balance?

Grywacheski: If you do carry a sizable credit card balance one of the better suggestions is to see if you can transfer that balance to a credit card that offers a 0% introductory rate for 6-12 months. This will allow you to continue paying down the balance without being charged 20% or higher for those 6-12 months.

But the challenge for consumers is that the biggest price increases over the past two years are on everyday basic necessities- food, clothing, housing, energy/gasoline. It’s not like these are luxury items that you can simply go without. You need to buy these items to provide for yourself and your family.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.