MOLINE, Ill. — The first half of 2022 was brutal in the stock market world, so investors have been enjoying a two-month "summer rally" as stock prices rebounded over that time. However, any hopes that the rebound would continue have been quickly dashed.

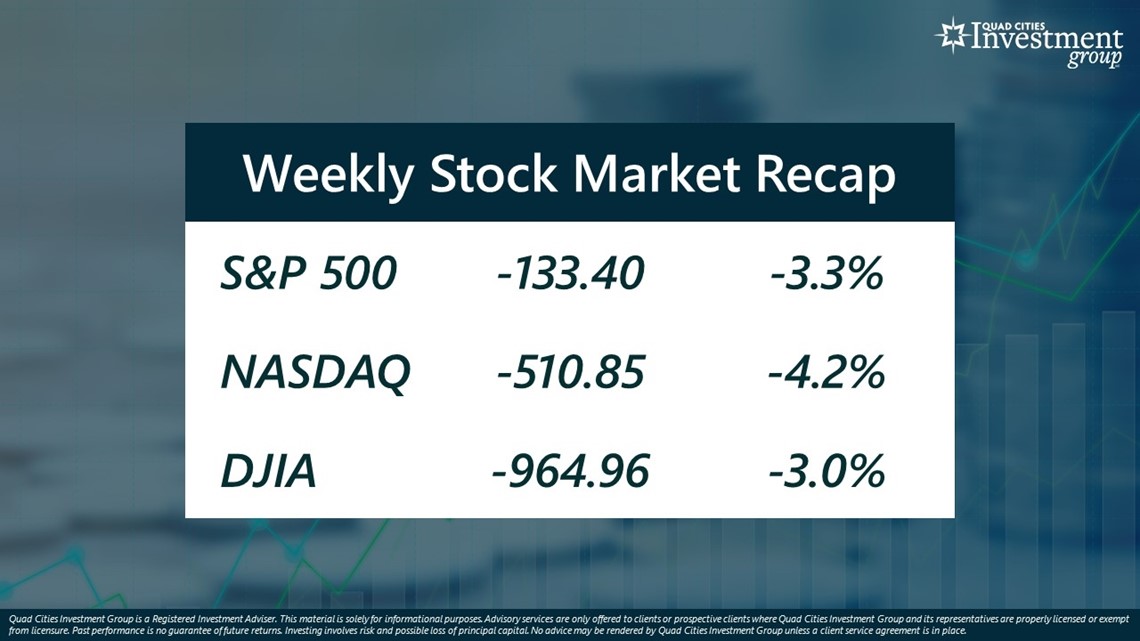

Over the last two weeks, the benchmark S&P 500 stock index has fallen by 3.3%, NASDAQ fell by 4.2% and DJIA fell by 3%.

Mark Grywacheski with the Quad Cities Investment Group recapped the stock market's sudden pullback with News 8's David Bohlman on Monday, Sept. 5.

Here's the full conversation:

Bohlman: What caused this sudden pullback in the stock market?

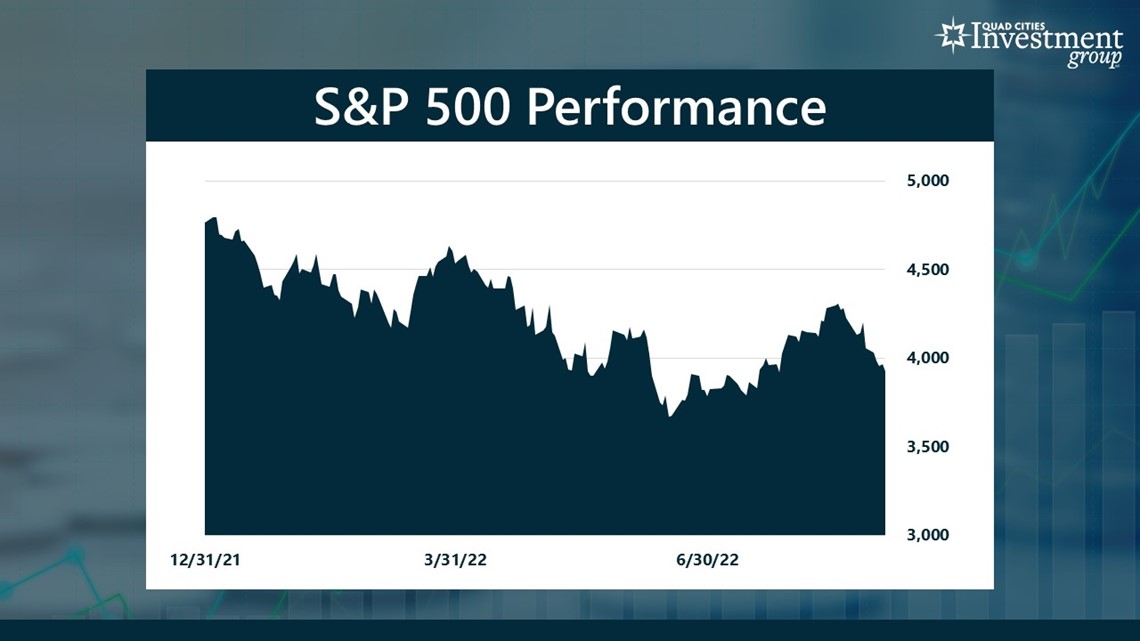

Grywacheski: This graph here shows the year-to-date performance of the S&P 500:

Remember, this initial six-month sell-off was caused by concerns over high inflation, rising interest rates and the health of the economy.

Now, from mid-June through mid-August, we did see this rebound on the hopes that "maybe" inflation had peaked and therefore the Fed wouldn't need to be as aggressive in raising interest rates.

But much of those hopes dashed a few weeks ago when the Federal Reserve said it doesn't expect to see a quick decline in inflation. And this means that the Federal Reserve will have to keep interest rates higher for a longer time to help get this inflation under control.

And the longer we have high inflation and high interest rates, the greater risk the economy will be severely impacted.

Bohlman: What's your outlook for the stock market for the rest of this year?

Grywacheski: In my opinion, the stock market is going to remain fairly volatile the rest of the year. As we get this steady flow of data over the next six months on inflation, interest rate hikes and the economy I think there’s going to be this ebb and flow of good news/bad news. And Wall Street will react accordingly. So I think we’ll continue to see these large price swings in the stock market the rest of the year.

Bohlman: When you see these big price swings in the stock market, what advice do you have for investors? Should they just get out of the market and wait for things to calm down?

Grywacheski: This is a stock market that’s going to require patience until Wall Street gets some level of comfort that inflation is under control.

If at all possible, avoid selling out because you’d be selling out near the low-point of this market decline. In fact, if you do have some extra money, now is actually a good time to buy into the market at these heavily discounted prices.

In the entire 130-year history of the U.S. stock market, the market has always rebounded. It’s always went on to set new all-time highs. We just don’t know how many days/weeks/months that will be.

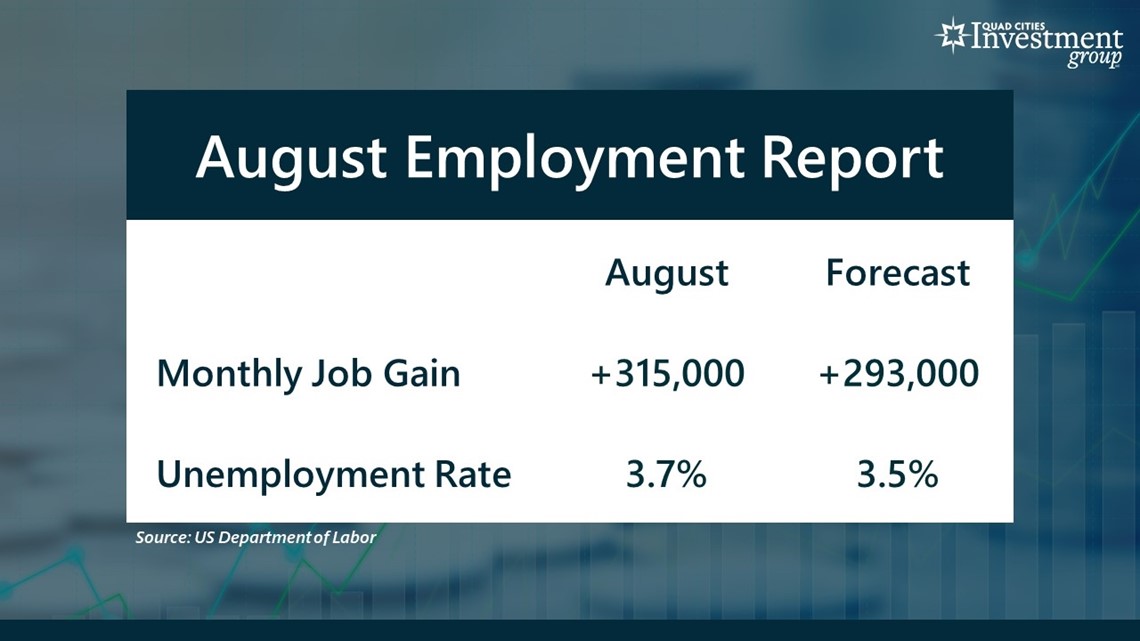

Bohlman: Finally, on Friday, the Department of Labor reported the national unemployment rate increased from 3.5% to 3.7%. Is there any cause for alarm in the labor market?

Grywacheski: Despite the unemployment rate increasing from 3.5% to 3.7%, the labor market remains one of those parts of the economy that’s still fairly strong.

We continue to see a steady pace of new jobs added each month. But that said, the labor market is expected to soften over the next six-12 months. We’re not talking a doom-and-gloom type scenario. But it wouldn’t surprise me if the unemployment rate edged higher to 4% in the next six-12 months.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch "Your Money with Mark" segments Mondays during the 6 a.m. hour of Good Morning Quad Cities or on News 8's YouTube channel.