MOLINE, Ill. — Financial Advisor Mark Grywacheski with the Quad Cities Investment Group joined News 8's David Bohlman Monday, June 13 on Good Morning Quad Cities to discuss tumbling stock market prices.

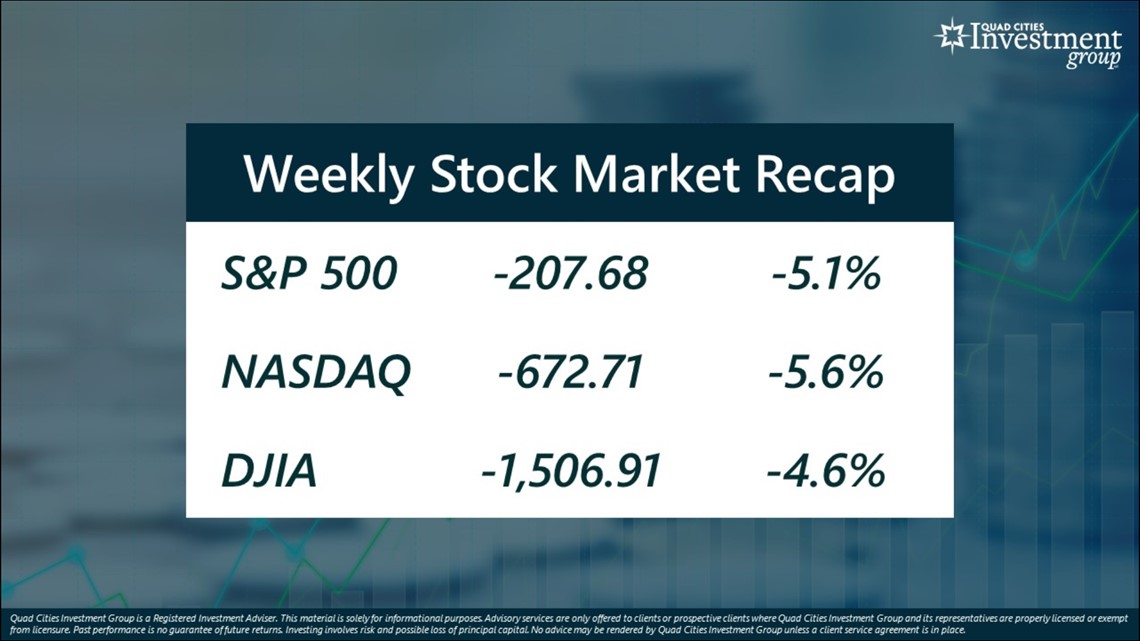

Last week, the S&P 500 fell 5.1%, NASDAQ lost 5.6% and the DJIA fell 4.6%. The DJIA has declined 10 out of the past 11 weeks while S&P 500 and NASDAQ have declined nine out of the last 10 weeks.

Find the full conversation below.

Bohlman: A lot of this sell-off in the stock market is being driven over concerns of inflation, but what are your latest thoughts on this decline we’re seeing in the stock market?

Grywacheski: It’s not just about inflation, but just as important, it’s about what this inflation triggers. To help get this inflation under control, the Federal Reserve must start raising interest rates. But this carries tremendous risk to the U.S. economy.

Historically, when the Fed starts raising interest rates, Wall Street wants these interest rate hikes to be spread out as much as possible to allow the economy to better absorb the impact.

But because inflation has risen so high/so fast, the Fed is now forced to “front-load” many of these interest rate hikes now and in the upcoming months. And that sudden shock to the economy from all these interest rate hikes in such a short window of time increases the risk of sending the economy into recession.

And it’s this concern of the economy going back into recession is what’s driving this sell-off.

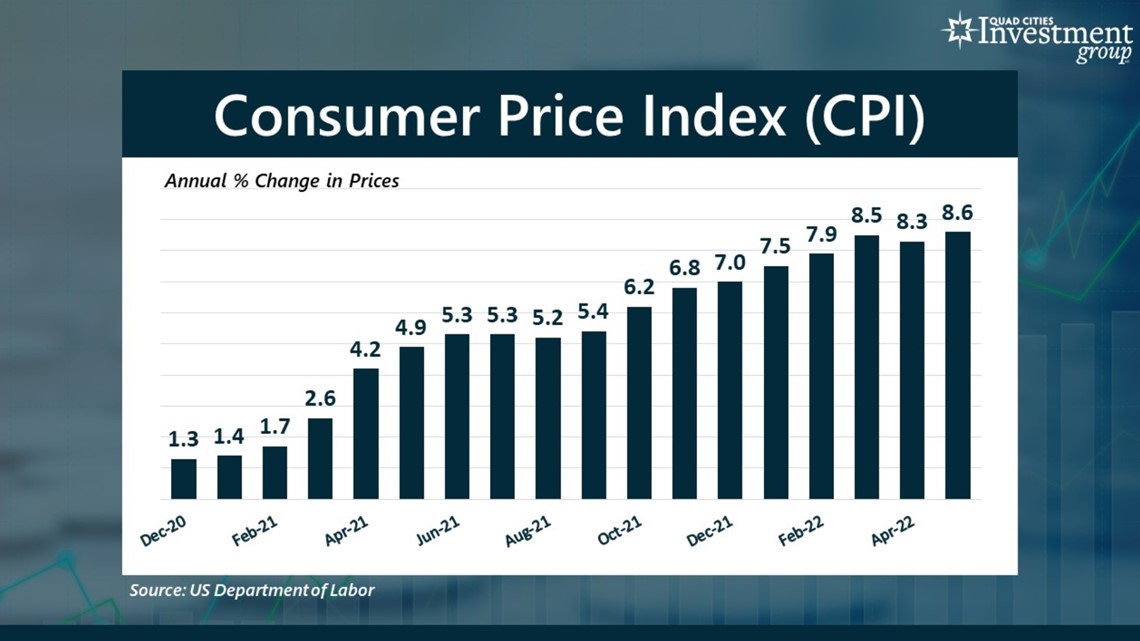

Bohlman: On Friday, the Department of Labor released the latest Consumer Price Index which showed that inflation jumped from 8.3% to 8.6%. What are your thoughts on the current state of inflation?

Grywacheski: This latest CPI number released on Friday morning really caught Wall Street by surprise. In April, inflation slightly declined from 8.5% to 8.3%. There was this “cautious optimism” that maybe inflation had peaked in March. In fact, Wall Street was projecting the latest inflation number would come in at 8.2%. But then on Friday, inflation was actually reported at 8.6% - a new 40-year high dating back to 1981. Unfortunately, this shows that consumer prices continue to rise at a very fast pace.

Bohlman: When do you think inflation will start to decline?

Grywacheski: Trying to predict this peak of inflation — as we’ve just seen — is proving to be much more of a challenge. But even when inflation does start to decline, it will be a gradual decline and inflation should remain historically high for quite some time. The ideal, target rate of inflation is 2%. But inflation is expected to remain above 2% for all of next year and potentially even into 2024.

Bohlman: Is there any way people can somehow lessen the impact of these high consumer prices that we’re seeing?

Grywacheski: Unfortunately, it’s very difficult to avoid these high prices. This inflation we’re seeing is a very broad-based rise in consumer prices. Over the past 12 months, prices for basic necessities, like eggs or gas, have increased by more than 30%.

These aren’t high-end luxury goods people can suddenly do without. These are everyday basic necessities: food, clothing, shelter, transportation. And especially for low-income and middle-class families, it’s now a challenge to even pay for these.

Have a question you want Mark to answer? Email your question to news@wqad.com and add "Your Money" in the subject line.

Watch "Your Money with Mark" segments Mondays during the 5 a.m. hour of Good Morning Quad Cities.

DISCLAIMER: Quad Cities Investment Group is a registered investment adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.