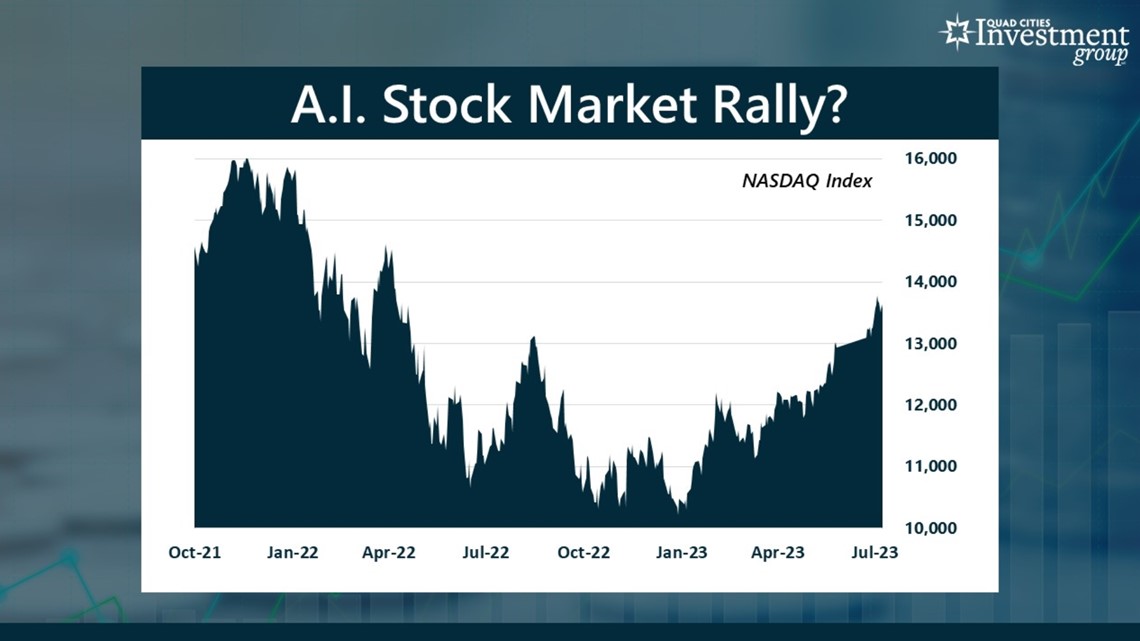

DAVENPORT, Iowa — Despite last week’s decline, the potential applications for artificial intelligence and how it can drive a new economy has sent the U.S. stock market surging over the past few months. So far this year, the tech-heavy NASDAQ stock index has gained 30%, much of that on the expectations of an expanding role of artificial intelligence within our economy.

On Monday, Good Morning Quad Cities' David Bohlman discussed AI's impact on the economy with Quad Cities Investment Group's Mark Grywacheski. Below is their entire conversation:

Watch more "Your Money with Mark" segments during the 6 a.m. hour of Good Morning Quad Cities or on News 8's YouTube channel.

Bohlman: What is Wall Street's interest with respect to artificial intelligence?

Grywacheski: With AI, it changes technology’s role from calculations and simple programming to mimicking the human abilities of critical thought and analysis.

From a broader standpoint, Wall Street’s fascination with AI is its ability to create efficiencies, productivity and achievements and how these can transform and drive a new economy. You think of the gains that can be made in robotics and manufacturing, science and mathematics, medical research and health care — the potential applications are near endless. More specifically, Wall Street is interested in identifying those companies that create this AI technology or can use AI to drive higher profits and revenues for its business.

Bohlman: For some years now, we’ve seen basic forms of artificial intelligence already being used. A good example is the self-driving and autonomous cars we currently see on the road. So what triggered Wall Street’s sudden interest in artificial intelligence and its potential?

Grywacheski: It really started when technology company NVIDIA released its first-quarter earnings. NVIDIA is a leading manufacturer of microchips and technology used in AI applications.

Over the past year, NVIDIA’s earnings rose 26% and its profit margin rose 46%. Its stock quickly increased by 44%. NVIDIA cited this surging demand for its AI technology as companies increasingly embrace AI to grow their own business.

Soon after, other companies like Microsoft, Google, Amazon and many others announced their AI initiatives. This created the realization on Wall Street that more and more companies are looking to AI as the future of their business.

Bohlman: In what ways are companies saying they will use this AI technology within their business?

Grywacheski: Right now, there seem to be two paths:

- For example, in engineering, healthcare, automotive or entertainment, AI can be used to provide a better product output or customer experience that can drive higher revenues.

- But we’re also starting to see companies embrace AI to reduce costs. For 2 ½ years, companies have been struggling to get people to return to the labor force. This has sent labor costs soaring. We’ve also had high inflation and now we have high interest rates. Companies are looking to AI- especially in robotics- to help keep their operating and labor costs down.

Bohlman: We’ve seen this surge in the stock market from Wall Street’s excitement over the potential that AI has. What are your thoughts for investors looking to capitalize on this?

Grywacheski: We had this initial surge in the stock market but last week’s decline is a cautionary warning that stock prices may have risen too high too fast. In my opinion, wait until stock prices come down a little. There’s still tremendous uncertainty over inflation, interest rates and the outlook for the economy.

But also, be very careful about investing in individual stocks. Right now, it may be better to invest in a fund that tracks the performance of the broader stock market like the S&P 500 or NASDAQ. As we saw just a few years ago during the pandemic, there was this rush to buy any biomedical or biotech stock as companies raced to find a vaccine. But as we usually see with these types of events, there tends to be a consolidation of key players- in this case, Pfizer, Jonson & Johnson and Moderna. Most of the other companies quickly saw their stock price plummet back down to where it started.

Quad Cities Investment Group is a Registered Investment Adviser. This material is solely for informational purposes. Advisory services are only offered to clients or prospective clients where Quad Cities Investment Group and its representatives are properly licensed or exempt from licensure. Past performance is no guarantee of future returns. Investing involves risk and possible loss of principal capital. No advice may be rendered by Quad Cities Investment Group unless a client service agreement is in place.

Watch: AI is here, there and everywhere. It's even taking your fast food orders