When it comes to YOUR MONEY, we want to take it a step further. That's why Mark Grywacheski appears on Good Morning Quad Cities every Monday to give us his analysis of the latest business, economic, and financial news.

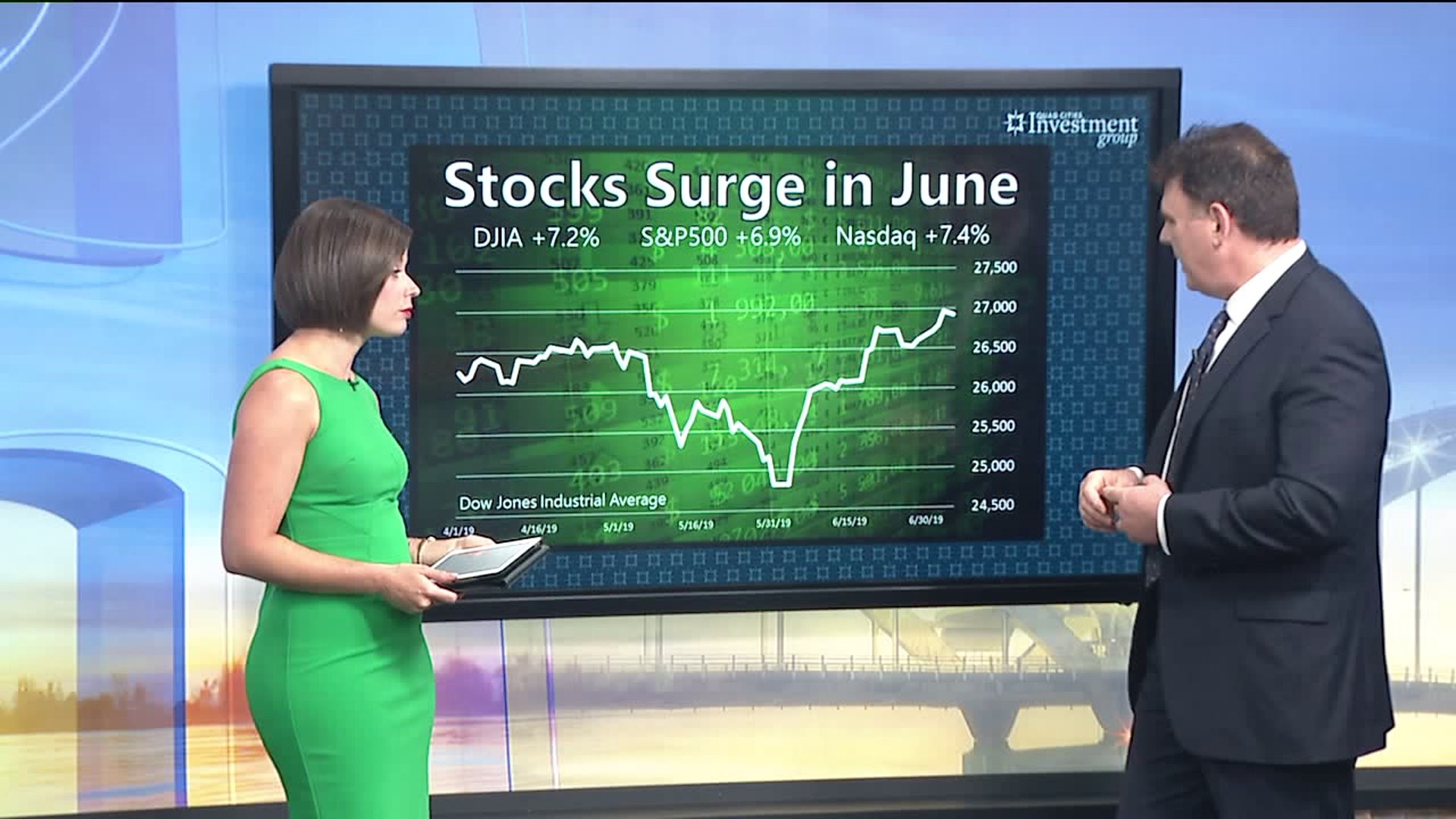

On Monday, July 8th, Mark talked about the Dow Jones Industrial Average, the S&P 500, and the NASDAQ setting new all-time highs right before the 4th of July.

"Not only did we set new all-time highs on Wednesday, July 3rd, but these all-time highs are coming off a record-setting performance in June," he explained. "The Dow Jones Industrial Average gained 7.2% - its best June performance in 81 years. The S&P 500 gained 6.9% - its best June performance in 64 years. The NASDAQ gained 7.4% - its best June performance in 19 years."

Mark said the surge in stock prices is tied to June 3rd, when the Federal Reserve stated it would be willing to start lowering interest rates.

"If the Fed decides to lower interest rates, it would make it cheaper for consumers and business to buy goods and services on credit - such as credit cards and bank loans. This would inherently increase spending by consumers and businesses, which further stimulates economic growth. The stock market is often viewed as a reflection of the strength of our economy. So, if lower interest rates help drive economic growth, that will be reflected in higher stock prices."

However, Mark said there's something investors need to be wary of. Click the video above to hear our entire conversation.