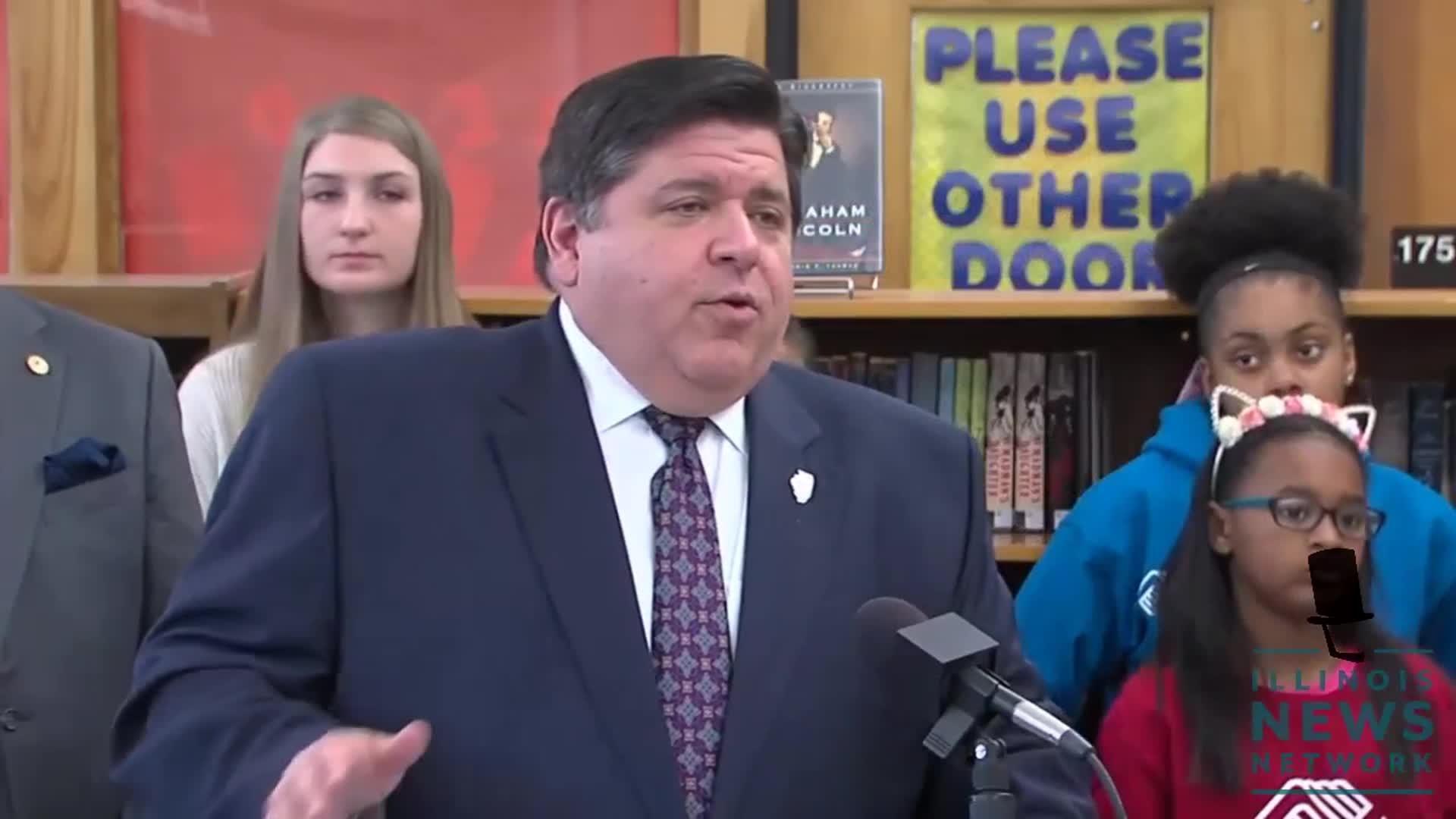

SPRINGFIELD (Illinois News Network) -- Gov. J.B. Pritzker has staked his future budgets on convincing lawmakers and voters to change the state's constitution to allow for a progressive income tax with higher rates for those who earn more, but not enough members of his own party in House are prepared to put the question to voters.

Fewer than 60 lawmakers in the House are in favor of asking voters to change the state's flat income tax to a graduated one, according to a report from Politico. That means Pritzker could have to look to other sources to come up with the more than $3 billion he said the state needs to stabilize its finances.

Pritzker ran on changing the flat income tax to a progressive one. For that, there would need to be a constitutional amendment approved by voters. The House would need 71 votes to pass it to voters. Multiple roll call votes on the progressive tax proposal registered support "in the 50s," Politico reported. To pass just the rates, if there were ever a constitutional change from the flat tax to the progressive tax, it would require a simple majority of 60 votes in the House.

"Leaders are having difficulty getting to 60 votes because some Democrats are pushing back on the measure. So the vote may be moved to April 30,” Politico reported.

Pritzker remained optimistic about his graduated tax plan on Thursday.

“I wouldn't believe everything you read,” Pritzker said in Springfield on Thursday.

State Rep. La Shawn Ford, D-Chicago, confirmed Democrats don't have the supermajority needed to get the constitutional amendment question on the ballot for voters.

“What we have now is a roll call that is short of the 71 votes, but we’ll see how the governor convinces the public and legislators and see things the way that many people do,” Ford said.

Ford said it’s important the governor doesn't attempt to force his will on the legislature and voters. The governor needs to hear their concerns.

Pritzker has proposed a graduated income tax structure that provide an estimated 97 percent of taxpayers with modest rate cuts and steep hikes for top three percent of earners. He said polling shows there’s support for his idea.

“Legislators who vote for it are listening to their constituents and legislators who are voting against are not listening to their constituents,” the governor said Thursday.

State Rep. Brad Halbrook, R-Shelbyville, said Democrats on the fence should join with Republicans to look at alternatives for the state.

“I think we need to be looking at some serious cuts and some serious reforms,” Halbrook said. “To change the constitution for a graduated tax, these folks are going to want to just continue to raise rates as we go down the road without having some serious reforms and cuts.”

Republicans for years have been pushing to address mounting property taxes, high workers’ compensation costs, and other changes to make Illinois more business friendly.

Ford said those who don’t trust government with more money will have their say, if the question is posed.

“The voters can still say ‘no’ to the constitutional amendment and say ‘we like the flat tax,’ ” Ford said. “So will the voters say ‘no’ to the constitutional amendment? We’re going to put it in front of voters and the voters will have a final say.”

The Senate sponsor of the constitutional amendment question, state Sen. Don Harmon, said he hopes to get it approved by the General Assembly before the end of the session.