Washington, D.C. (CNN)-- The famously slow-moving Federal Reserve has done a rapid reversal.

In mere weeks, the Fed went from signaling two interest rate increases in 2019 to suggesting it could be done with rate hikes altogether. Fed chief Jerome Powell went from saying the balance sheet is on "autopilot" to opening the door to adjusting the policy.

In effect, the Fed slammed on the brakes. On Wednesday, January 30, the Federal Reserve had its January meeting, but this time didn’t raise interest rates.

The speed and extent to which the Fed reversed itself is striking. The 180-degree turn led to immediate speculation that the central bank is surrendering to pressure from Wall Street. Recall that fears of an overly aggressive Federal Reserve helped send markets plummeting in November and December.

"It is difficult to read the outcome of the January FOMC meeting as anything other than the Fed capitulating to recent market volatility," Barclays chief US economist Michael Gapen wrote in a note to clients.

Charlie McElligott, cross-asset macro strategist at Nomura, said the Fed "utterly 'bent the knee' to the stock market."

"Equity prices now set policy I guess and not the other way," McElligott wrote to clients.

Not surprisingly, Wall Street liked what it heard. The S&P 500 rallied 1.6% on Wednesday, notching its first advance on a Fed decision day since Powell took the helm.

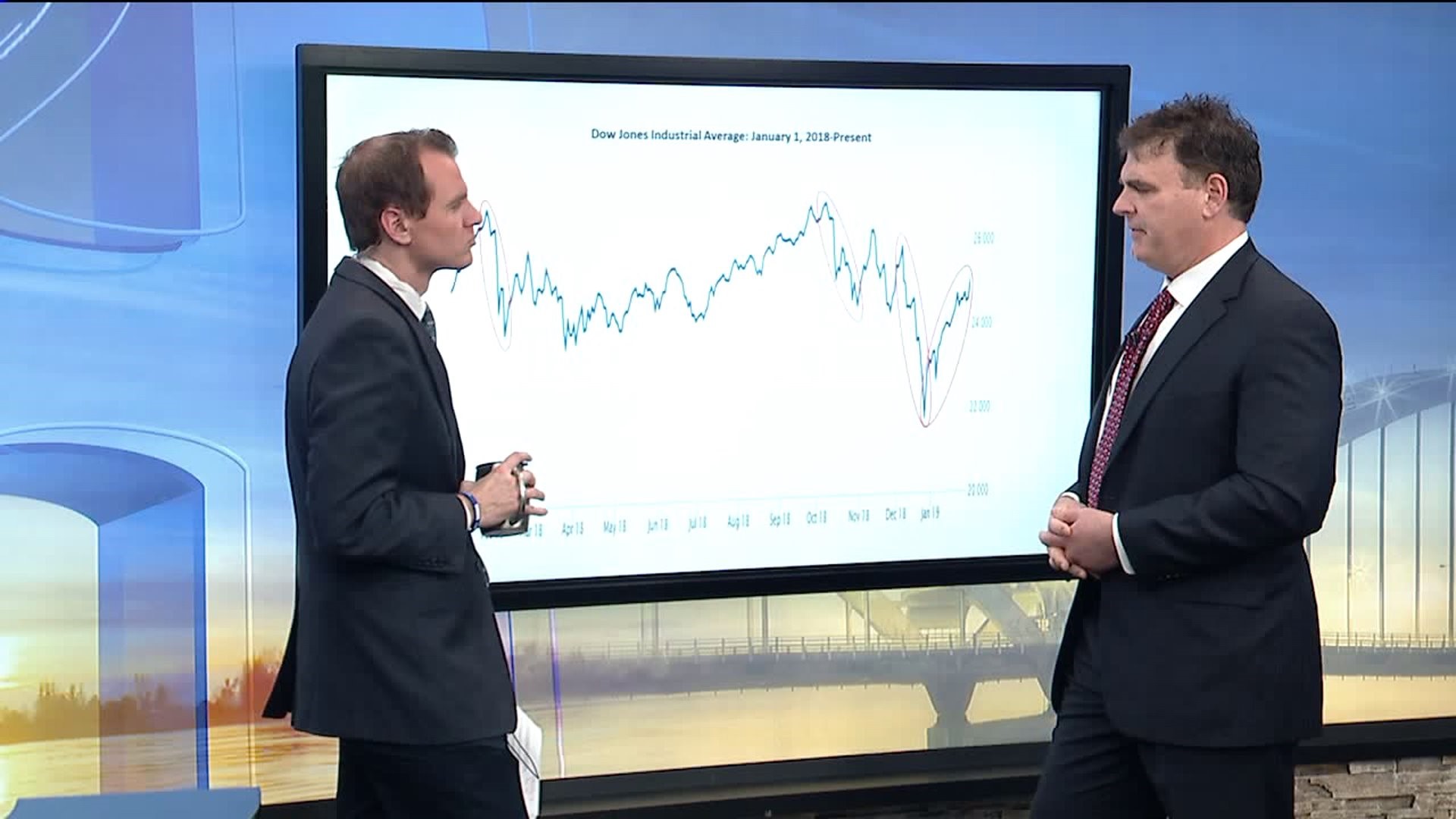

Local Investment Advisor Mark Grywacheski dug into how the Fed has impacted the stock market. He joined us Monday, February 4. Your Money with Mark airs between 5 and 5:30 a.m. only on Good Morning Quad Cities. To live stream any of our newscasts, click here.

"From that December 24th low until Friday's close, the Dow has since gained 15 percent," Grywacheski said Monday. "We just had the strongest January we've had in 30 years."

Worse, others worry the Fed is caving to Washington. Last year, President Donald Trump launched relentless attacks on Powell for raising rates too quickly. Rumors even swirled that Trump could do the unthinkable: fire Powell.

Trump cheered Wednesday's market rally, calling it "tremendous news!"

"For the first time I can recall, it appears that a sitting president has pressured a Federal Reserve Chairperson into an abrupt policy change," said Ian Winer, a former market strategist at Wedbush Securities who is now an advisory board member at Drexel Hamilton. "This precedent now brings into question the long-held assumption that the FOMC is independent of political whims."