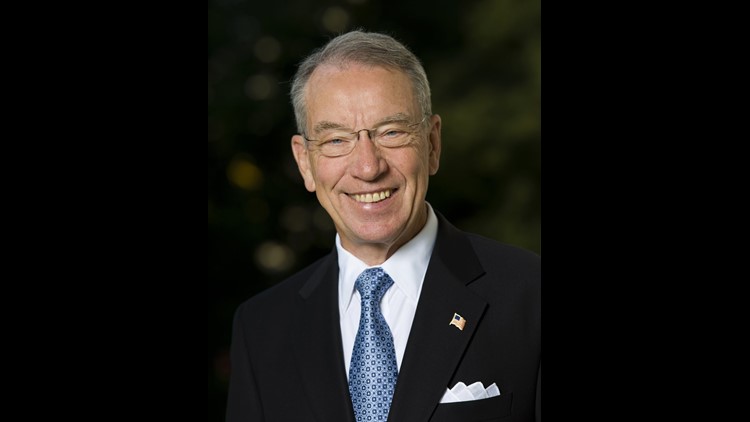

Grassley told the newspaper, “I think not having the estate tax recognizes the people that are investing as opposed to those that are just spending every darn penny they have, whether it’s on booze or women or movies.”

The estate tax affects a very small and very wealthy number of Americans, with only the estates of about 2 out of every 1,000 Americans who die facing the tax.

Under current law, when someone dies the estate owes taxes on the value of assets transferred to heirs above $5.5 million for individuals, $11 million for couples. The Senate bill doubles those limits but does not repeal the tax. The House bill initially doubles the limits and then repeals the entire tax after 2023.

Grassley’s comments have been criticized by many, including Progress Iowa, which called on the senator to apologize.

“Senator Grassley owes an apology to his hardworking constituents and to every working family in America,,” said Progress Iowa director Matt Sinovic. “It is the height of elitism to suggest that people who aren’t multimillionaires have wasted their money. Senator Grassley has been an elected official since the Eisenhower administration, and has had almost 60 years to help build the middle class. Instead, he’s done his darndest to stunt the dreams of American workers while tilting the scales for the extremely wealthy.”

Grassley subsequently said his comments were misinterpreted.

“My point regarding the estate tax, which has been taken out of context, is that the government shouldn’t seize the fruits of someone’s lifetime of labor after they die,” Grassley said in a statement. “The question is one of basic fairness, and working to create a tax code that doesn’t penalize frugality, saving and investment.”

House and Senate GOP negotiators are working out the differences between the two bills, with the goal of completing legislation that Congress can send to President Donald Trump before Christmas.

Farm-state lawmakers and other Republicans have long argued that the estate tax is a harsh hit on small businesses and family farms. The Tax Policy Center has estimated that only 80 small business and small farm estates nationwide will face any estate tax in 2017.