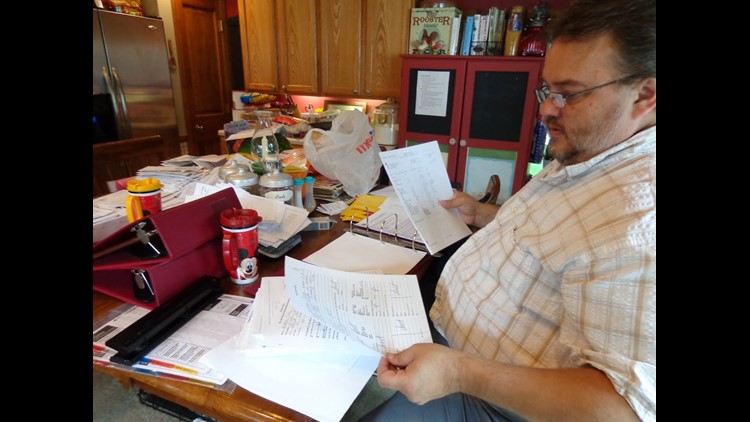

HUNTLEY, Illinois (Illinois News Network) — Steinar Andersen is a disabled veteran, widower and father of a disabled stepson who is ready to move out of Illinois.

But he can’t. Employed as a information technology manager, he and his wife bought an old farmhouse near Huntley in 2005. After the housing bubble burst and the state widened a nearby road, he’s deeply underwater on his loan.

“I still owe $187,000 in principle,” said Anderson, 55, now fully disabled from a service-related injury. “Once I get to $90,000 in principle in about 10 years, I’ll be able to sell at a $130,000 loss.”

“We really should be living in Arizona as it is more ‘disability friendly’ and the property taxes are much less,” he said.

Andersen isn’t alone.

Collen Percy and her recently retired husband are $85,000 underwater on their suburban Plainfield home. They’re worried about property taxes eroding their home’s value further, pushing a potential payoff of their home further into their twilight years.

“We’re stuck,” she said. “We would love to sell [our home] and go live in a smaller home so we don’t have the upkeep and tax burden.”

Two new reports on home equity reveal that a number of Illinoisans, like Anderson and Percy, may be chained to to the state by a mortgage larger than their home is worth.

A study of negative equity by real estate site Zillow found 16.4 percent of Illinois homeowners with a mortgage owed that is more than their home was valued as of the end of 2017.

“There are several metro’s throughout Illinois that are even higher,” Zillow economist Sarah Mikhitarian said.

Centralia, Dixon and Canton are the highest, with nearly two of every five mortgages underwater. Chicago, Illinois’ economic engine and home to the state’s highest wages, saw 15 percent of mortgages carrying negative equity, representing $28 billion in lost home value.

Having an underwater home mortgage can create serious hurdles.

“It makes it difficult to move for a new job opportunity to relocate elsewhere,” Mikhitarian said.

The state’s income growth since the recession has run congruent to Mikhitarian’s notion. According to Pew Charitable Trusts, Illinois has seen 0.6 percent income growth since 2007, less than half the national average and only better than Connecticut.

High property taxes can push the value of homes further into the depths, experts say.

“There is nothing left in this state to want to remain living here,” Andersen said.