WASHINGTON, D.C.-- Negotiations for the massive tax reform bill ran right up to the last minute. Early Saturday morning, December 2nd, Senate Republicans passed the biggest overhaul of the tax system in decades.

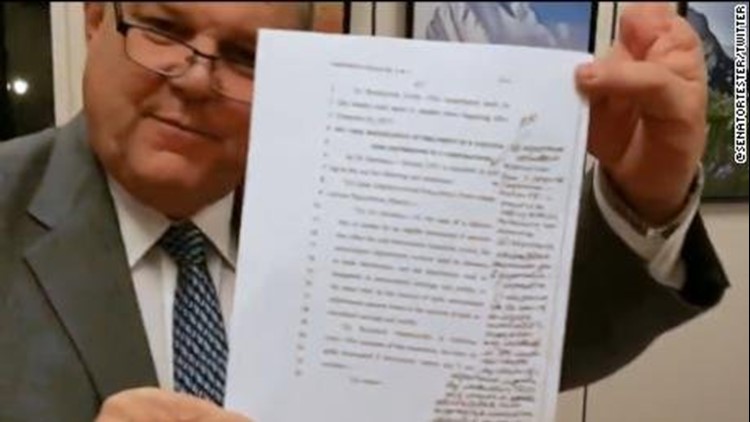

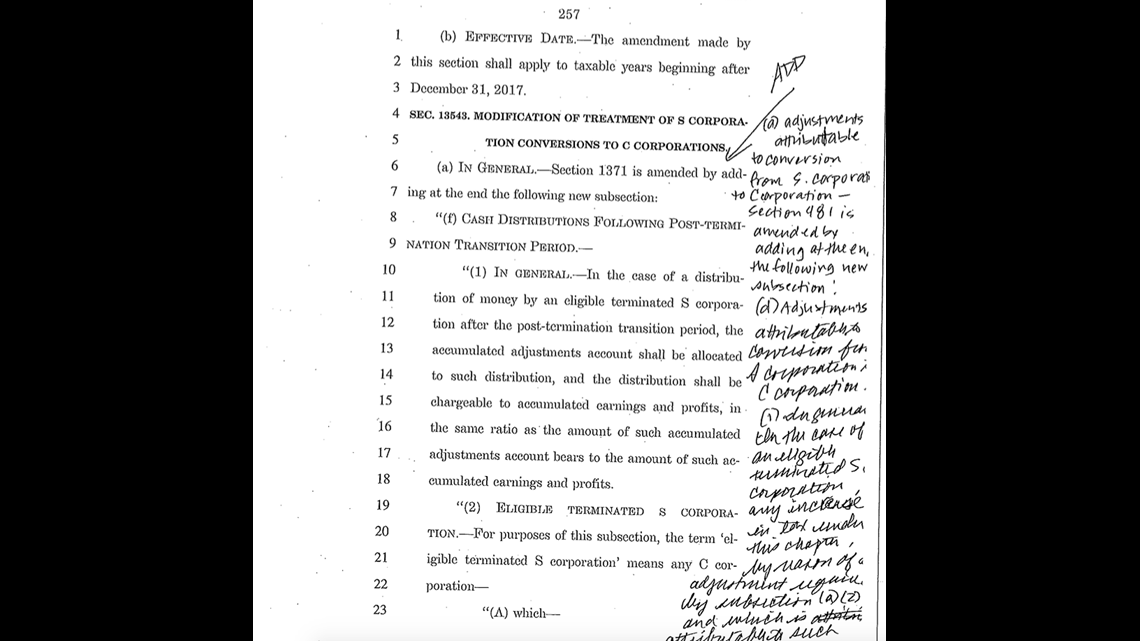

Senators were handed a final copy of the nearly-500 page tax reform bill just hours before last night's vote. And after scribbling changes into the margins of the plan, Senate Republicans were able to make enough changes to pass it, paving the way for what will likely be President Donald Trump's first and only legislative victory of the year.

The most costly part of the bill lowers the corporate tax rate to 20 percent. Republicans argue the measure will pay for itself, but that has been debunked by the nonpartisan Joint Committee on Taxation. This week, the group said the bill would add at least $1 trillion to the national deficit over the next ten years, while growing the economy less than one percent.

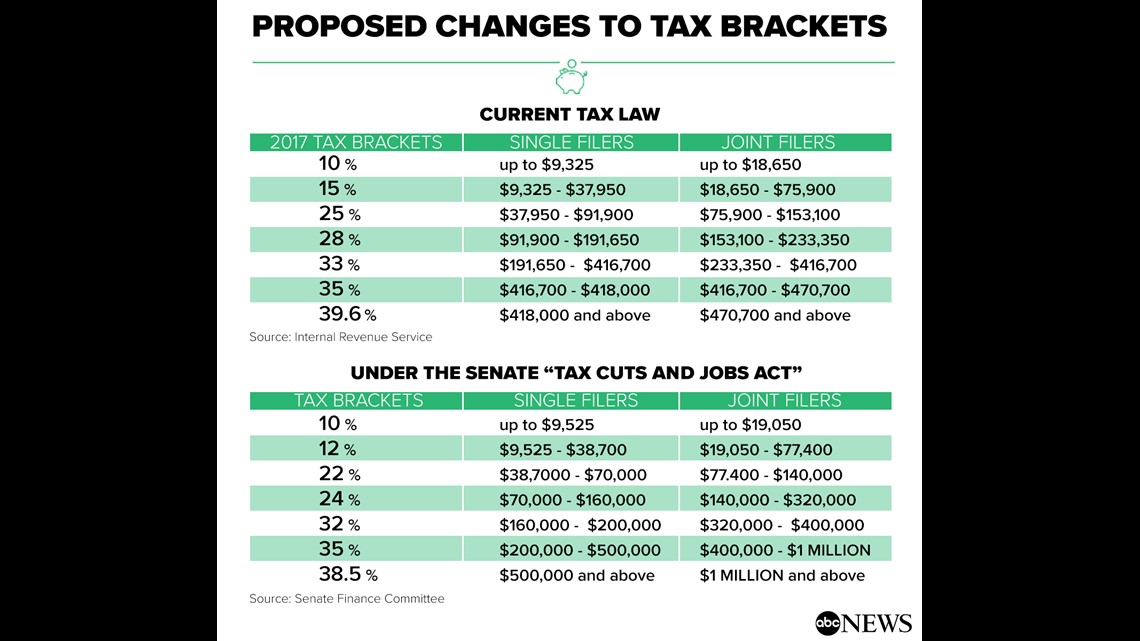

When it comes to individual income taxes, the Senate's plan makes cuts across most income levels, but those cuts will expire after the year 2025, unless Congress acts.

By 2027, every income group under $75,000 is expected to see their taxes rise.

The corporate rate cut, from 35 percent to 20 percent, will be permanent.

All Democrats voted against the plan. Senate Minority Leader Chuck Schumer (D-New York) was one of its most vocal opponents. "Because the bill was given to us so late, I move we adjourn until Monday, so we can read it and clean up this awful piece of legislation," Sen. Schumer argued on the Senate floor.

Senate Majority Leader Mitch McConnell (R-Kentucky) vehemently disagrees. "Everybody had plenty of opportunity to see the measure," he said. "You complain about the process when you're losing and that's what you heard on the floor tonight."

The bill isn't quite ready for President Trump's signature just yet. The House can either hold a vote on the Senate bill, or the two chambers can come together and create a reconciled bill that would have to be approved by both the House and the Senate.

That process is expected to take another couple of weeks.

2017 rates versus your rate under the Senate bill

The Senate bill maintains seven brackets, the same number as exist under current law, but it also lowers most of the rates and raises many of the income thresholds. For example, a married couple making $200,000 in 2017 would have paid $42,884.50 in taxes. Under the Senate bill, they would move from the 28 percent to the 24 percent tax bracket, and their tax bill would drop to $37,079 — before deductions are considered.