A Chicago-based group is calling for pension reform, and is highlighting what it calls some of the top area pensions to make its case.

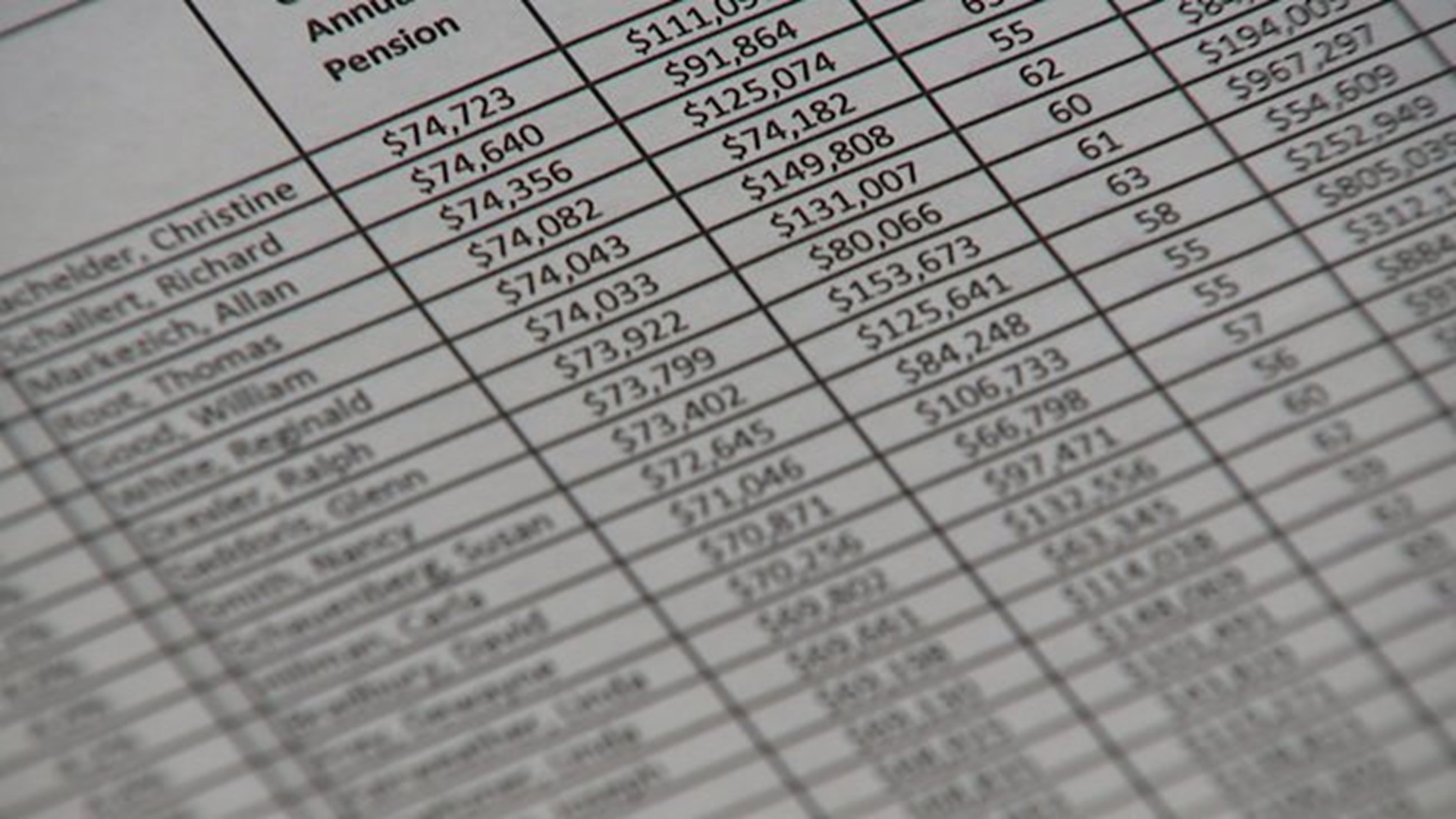

According to data provided by Taxpayers United of America, ex-Moline school superintendent Cal Lee is collecting a more than $197,000 a year pension.

But, TUA says he has only contributed about $390,000 to his pension fund, leaving taxpayers to supplement his estimated lifetime payout of 7.2 million dollars.

"So in two years, he's already recouped the money he's put into his pension fund. If you look at his lifetime pension, estimated at over 7-million dollars, I don't think these pension funds were initially started to create millionaires out of government employees," said Jared Labell, Director of Operations for Taxpayers United.

The group is calling for pension reform, and wants lawmakers to pass some kind of legislation requiring 401k type funds for future city and state workers and educators.

Labell says the current system is not sustainable, and unrealistic.

"We're seeing it all across Illinois. The conservative number is 111 billion dollar in unfunded liabilities to taxpayers. Different employees aren't paying enough into the system to make it sustainable and we're seeing as the market ebbs and flows, more and more responsibility falling on the taxpayer to actually fund these pensions," he said.

TUA says there are more than 12,000 state pensioners collecting more than $100,000 per year and more than 85 thousand state pensioners collecting more than $50,000 per year.