State employees will face a later retirement age and big changes to their cost-of-living adjustments now that Illinois legislators passed the latest version of pension reform.

Tuesday, Illinois lawmakers met in Springfield to vote on a pension reform bill. The bill passed both the House and Senate.

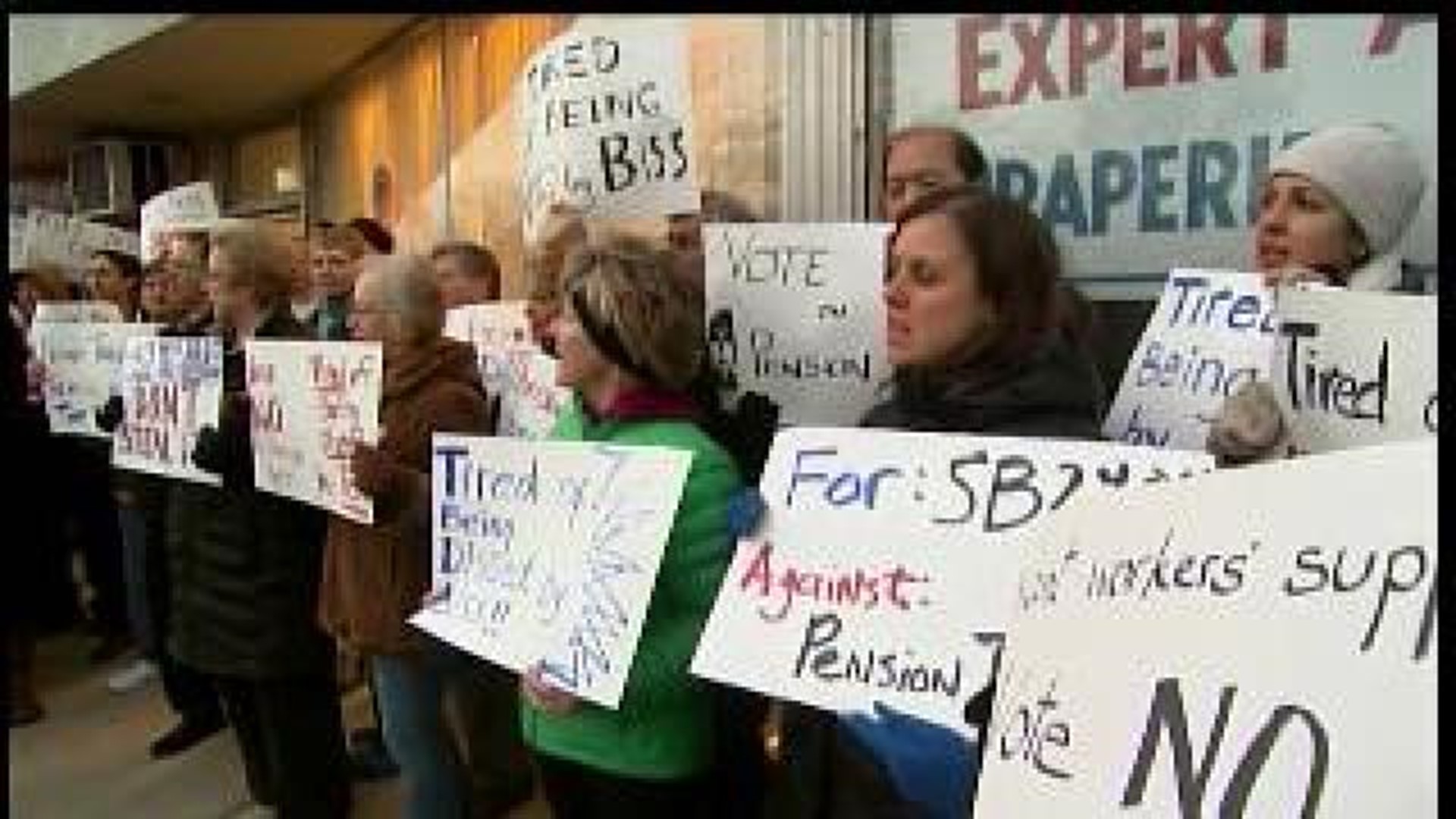

Many State workers shared their voice Tuesday in opposition of the bill.

“We think it’s illegal and it’s a kick in the teeth for public employees and school teachers,” said Jeff Conrad with the Illinois Education Association.

Conrad represents teachers in the Quad City area and has followed the pension reform since its early stages. He told News 8 how lives will be drastically changed.

“Teachers are going to have to teach longer and their benefits are going to decrease. The bill would also decrease the cost-of-living increases for people that are already retired,” said Conrad.

Illinois currently owes more than $100 billion in debt to the state’s pension system. The bill will erase the pension shortfall by 2044. It will also reduce the pension system’s current debt to $79 billion, a 21 percent decrease.

Chicago owes more than $33 billion in unfunded pensions, yet all Chicago employees are excluded from the change.

Currently in Illinois, state employees who have worked in their profession for 35 years can retire. The new bill requires state employees to work until they are 67.

In addition, those 50 and older will miss one bump of their cost-of-living increase. Workers 43 and under will miss five bumps spread out over the years.

These decreases will directly impact money that state employees rely on.

“Your cost-of-living increases will be decreased by one-third over 20 years in retirement, should you live that long,” said Conrad.

Conrad believes one of the scariest consequences of this bill could be young educators reconsidering their career path.

“I don’t think people are going to make education a career, it scares me,” said Conrad.