In the story below, we identify one of the loopholes in the proposed Illinois pension reform legislation, and who that loophole hurt.

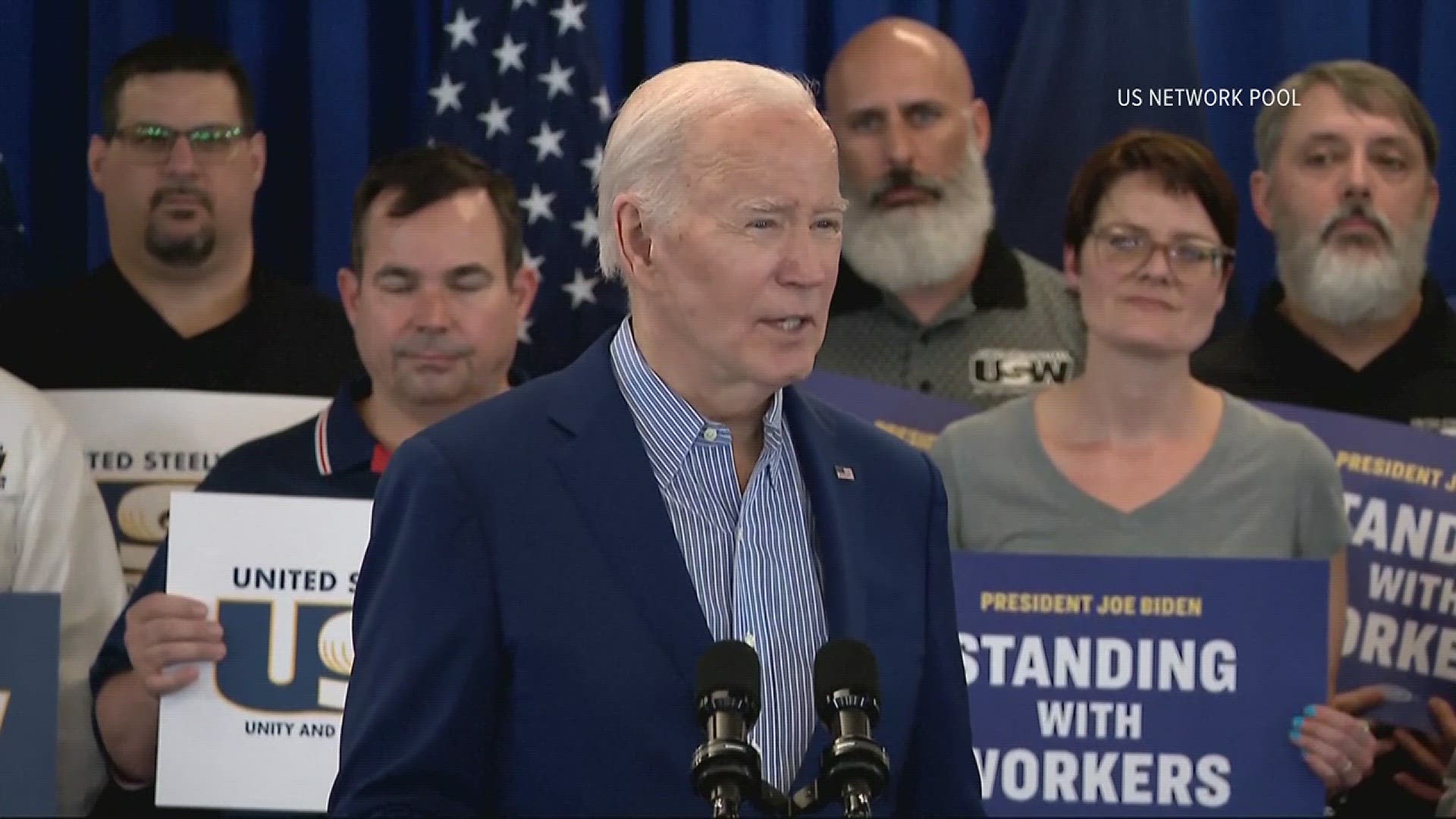

Legislators now say they have closed some of those loopholes. News 8’s Jenna Morton explains which loophole survived as pension reform became law, and who wins and loses in pension reform that was passed in Illinois – Monday, February 24, 2014 on News 8 at 10 p.m.

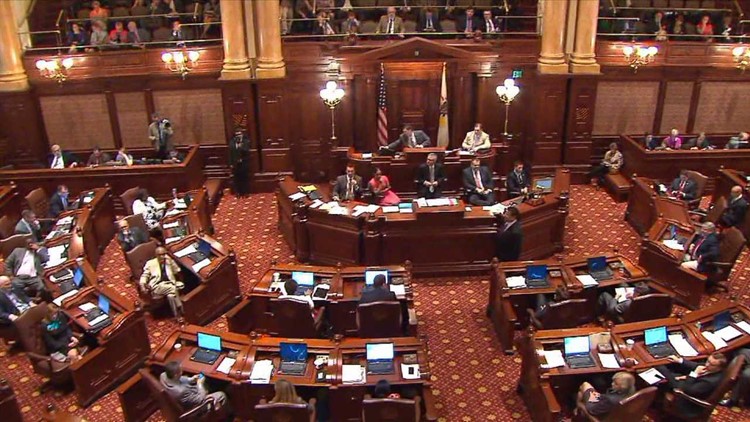

The state faces a $100 billion pension crisis, and Illinois lawmakers have yet to come up with a pension reform.

Amid all the debate over the state's pension crisis is a little-known secret in Springfield. It's a loophole that allows non-state employees to also collect public pensions.

"I did not think that was something that should be happening in Illinois, particularly when we're facing such a huge pension crisis," said Emily Miller, of the non-profit watchdog group Better Government Association. "You know, there are public workers who work really hard and deserve those benefits. But, you know, private employees don't deserve the benefits that public employees do."

Employees of 13 non-government groups are currently eligible for publicly-funded pensions in Illinois, including lobbying groups like the Illinois Association of Park Districts and the Illinois Principal's Association. Workers for such organizations may be paid by member dues, but they are entitled to the state's public pension system.

"I think it's the kind of thing that causes, understandably, a lot of concern out there for voters," said State Representative Elaine Nektriz, (D) from Northbrook.

Nektriz says the loophole was created when a court ruled in 1982 that people in certain organizations affiliated with government groups, such as a university, a school system or a park district, were all eligible for state pensions.

"They're paying in, so they're paying their share toward it, but it creates an inequity, because that means everybody maybe ought to be able to pay in and receive that," said Nekritz.

While the dollar amount might seem like a drop in the bucket, Miller says the bucket's overflowing right now and it's more about the principle than the money.

"It's not fair to the taxpayers that private employees would be able to benefit from a taxpayer-backed system," said Miller.

There is currently legislation up for debate in Springfield that would prevent employees of those organizations from getting a public pension.

However, until pension reform is passed, loopholes like this will continue. Some say the loophole is just one example of abuses for which lawmakers need to take responsibility.